Hi there, fellow Reader. I hope you had a terrific start into the New Year!

I want to share with you a brief look back at the passed year focusing on my achievements in terms of passive income and I will also make some projections regarding future cash flow streams.

USD 4’500 dividend payments from businesses

- dividends from my stock holdings and

- interest payments from corporate bonds and on my savings account

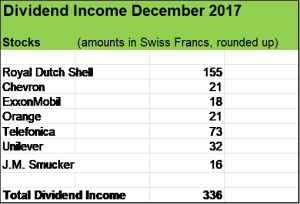

In December 2017 I collected USD 336 in dividends, bringing the total amount for the year to USD 4’510 (in that number, the Tax Refunds 2017 on my Swiss Holdings are included).

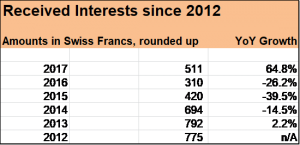

Adding USD 511 in interest payments from corporate bonds and interests on my savings account, my passive income totals USD 5’021, hitting my full year goal!

That’s an increase of 22 % compared to last year (dividends in 2016: CHF 3’800; interests: USD 310).

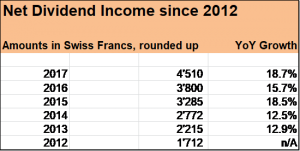

Robust Dividend Growth Rate since 2012

I have been tracking my passive income since 2012.

Dividends really have been my passive cash inflow driver, on average growing around 15 % year by year.

There are three factors driving these annual increases:

- organic dividend growth (when companies boost their payouts per share),

- reinvestment of dividends (into same positions via Dividend Reinvestment Plans or by acquiring new stock positions) and

- investment of new funds (savings from my day-job) into new stock positions

New stock acquisitions contribute to around half of the annual dividend income growth, the other half derives from dividend hikes and reinvestments.

My current Yield on Cost (YoC) for the whole stock portfolio (consisting of around 35 positions) is slightly above 3.5 %.

I have a nice mix of rock solid businesses with a rather low YoC but very interesting growth prospects ahead such as The Walt Disney Company (1.5 %) or Heineken (2 %) and on the other side a broader spectrum with some higher yielding businesses such as Royal Dutch Shell (7.4 %), Deutsche Telekom (4.1 %), HSBC (6.2 %), AVIVA (5.5 %), Legal & General (5.5 %), Zurich Insurance (7.8 %), Rio Tinto (4.5 %), Imperial (4.2 %) Brands or Glaxo Smith Kline (5.1 %).

I expect some of these companies to show nice organic dividend growth in the coming years (I am thinking in particular of Walt Disney, ReckitBenkisser, J.M. Smucker, AVIVA, Legal & General) and there are some positions where I think that there won’t be too much of a dividend hike in the near future. For example Chevron, Zurich Insurance and Royal Dutch Shell are very good dividend payers but I guess that the cash payments I receive from these fine businesses will remain pretty flat.

There are some businesses in my portfolio that showed slowing (dividend) growth over the past few years. Is this a cause of concern? No, unless the business fundamentals deteriorate, why not keeping these stocks and harvest all the fine dividends? Just looking at the YoC of Nestlé (4.9 %), Novartis (4.3 %) and Roche (4.9 %), I cannot see any reason to lament about slowing dividend growth.

Putting Parking Money to work

As we are looking for our dreamhouse, a relatively large portion of our wealth is “parked” on savings accounts and invested in corporate bonds which is to the substantial detriment of our profitability as that money is not effectively working for us.

On the other hand though, “sitting on a cash pile” has some advantages as we can quickly pull the trigger when interesting investment oportunities arise. Most importantly, we are able to buy a house without having to sell one single share from our portfolio. A large cash pile also gives us bargaining power for negotiations with banks if we decided to take a mortgage.

And we could also take profit if stock markets take a dive. We love to invest into great businesses, especially when they are on sale.

So, unproductive money gives us tremendous flexiblillty.

We took some measures to improve our returns on our “parking money” which have been falling over the previous years amid plummeting interest rates (see graph below). What we did is shifting some money from our savings account (only yielding 0.1 %) into corporate bonds (yielding 0.5 % and 0.4 %) running until 2019 and 2020. Of course we still have some better yielding bonds in our portfolio, but they will expire in 2018 and 2019.

My passive income goals for 2018

For 2018, I target a total passive income of CHF 6’000, representing a 20 % increase compared to 2017.

Interest income on our savings account and from bonds is likely to remain flat at USD 500. So again, dividend payments will drive my passive income growth in 2018. I expect These inflows to reach at least USD 5’500.

Several positions acquired in 2017 will become fully productive such as Henkel, BMW, AVIVA, Legal & General. Furthermore, following four new stock holdings have only be partially productive in 2017: ReckitBenkisser, Imperial Brands and J.M. Smucker. In 2018, these seven companies alone will provide me with additional dividend income in the amount of roghly USD 500.

My goal is to invest at least USD 15’000 in dividend paying stocks in 2018, fueled by a savings rate lying comfortably between 50 % and 65 %.

I also plan to reduce my work pensum to 80 % in 2018 as I want to spend more time with my family. In this case, my savings rate is likely to settle at the lower end of my target range (at around 50 %) which still gives me room to invest at least USD 15’000.

What about you, fellow Reader, how was your 2017 in terms of passive income? Which goals did you set for the New Year?

Thanks for reading my post and for sharing your thoughts.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Thanks for that great look back! I wish you all the luck for 2018! I don’t like bonds as they don’t keep up with inflation. However, I see why you own them and I hope you will be able to take advantage of the money in your cash pile and can make some great investment decisions in this year. I will follow your progress closely!

Best wishes, Sir Budget

Hi Sir Budget

Thanks, I wish you a Great Year as well!

I am really happy with our achievements in 2017 and will give my best to keep the ball rolling. With regard to bonds, yeah, I see it the same as you, at best, I see it as a parking place. We keep our eyes open for investment opportunities, waiting for the pitch that really is in our sweet spot.

Appreciate your continued support and your commentaries.

All the best.

Hi Financial Shaper,

You‘ve put together a real nice mix of high-yield and dividend growth stocks. It must be very satisfying to see, how such a portfolio is fueling itself for further growth!

Congrats to your decision to reduce your work load to 80%. I guess your family must be very happy about that decision.

All the best for 2018. Keep up the good work!

– David

Hi David

I wish you all the best for 2018 as well!

With regard to my portfolio, yeah, I like the combination of high yield and dividend growth stocks providing me with a strong and growing income stream.

The decision to work 80 % really will give me and my family so much more flexibility, I am really looking forward. In a first step, I reduced to 90 % (then probably in summer finally to 80%), so I have each Thursday afternoon for my Family. It’s just great!

Appreciate you stopping by and commenting.

Cheers

Great job!

Hi Caroline

Thanks for your support and for stopping by!

Cheers

Great job with the tracking! Your portfolio is very well-rounded with strong companies. I like that you push higher what the more predictable goal would have been (around $5,400), that’s what it’s all about! Best of luck for 2018 and I hope you do spend some time with the family 🙂 Cheers!

Hey Dividend Investor

Thanks for your kind words. Yes, it’s fantastic to have more time for my family after having reduced my work pensum.

Dividend growth investing really is amazing, as you said, we can focus on and work towards very predictable goals which is very empowering.

I wish you a great year as well!