Hi there, fellow reader.

It’s time for another dividend income update and I also want to share with you two new stock buys.

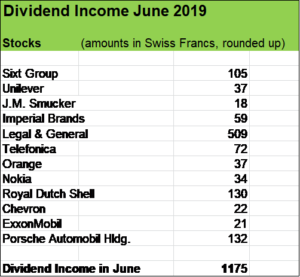

June passive income jumped from USD 550 one year ago to almost USD 1’200

Let’s dig deeper into the numbers and breaking down the increase of USD 625 compared to the previous year (the numbers are in Swiss Francs resp. in USD, which on average have been trading more or less at parity over the last few years). Our June year over year (YoY) passive income boost of more than 100 % from our investment portfolio is the result of a combination of following five factors:

- one new stock position (Sixt Group, adding USD 130),

- top-up of existing position in British insurer Legal & General (which added USD 300),

- dividend hikes of existing positions resulting in very robust organic growth of around 8 % (resp. USD 50 YoY),

- participating in dividend reinvestment plans of tobacco company Imperial Brands and Legal & General which led to a passive income boost of USD 15,

- change of the dividend payment date of Porsche Automobil Holding which this year made its distribution in June whereas in 2018 the payment has been made in May (this “technical factor” increased our June result by USD 132)

Putting a plattform in place, consistently generate organic passive income growth is tremendously important for us. My wife and I want to see our passive income machine grow on average by 8 % due to dividend increases. And looking at our June dividend payers we are quite happy that latest increases have been pretty in line with our expectations:

- Sixt Group: 10.2 %

- Unilever: + 8 %

- JM Smucker: + 9 %

- Imperial Brands: + 10 %

- Legal & General: + 7 %

- Chevron: + 6.2 %

- Exxon Mobil: + 6.1 %

- Orange: + 7.7 %

- Nokia: + 5.2 %

- Porsche Automobil Holding: + 26 %

Spanish Telefónica and British-Netherland oil and gas supermajor Royal Dutch Shell held their payouts steady.

Taking a stake in 3M and Victrex

Late in May we acquired stocks of industrial giant 3M and in June entered into a position in British company Victrex (for roughly USD 3’500 each).

Amid tariff disputes and recession fears, cyclical companies have come under pressure and in the case of 3M, after very disappointing first quarter 2019 results, the stock has sold off pretty steeply from its higs.

When shares of a high quality companies such as 3M with an amazing dividend track record, strong financials and such an amazingly diversified business model with a vast brand and product portfolio come down, well, it certainly catches our attention.

My wife and I stood at the sideline quite a while until late in May I put a purchase order slightly below USD 160 which was triggered on 31 May.

Just to be clear, a purchase price of around USD 160 is certainly not cheap for 3M. We are talking about a cyclical company clearly facing some severe headwinds (slowing growths, litigations etc.). But looking at the valuation (below 20X earnings) and particularily looking at the current dividend yield, it was just too tempting for us.

I wouldn’t be surprised to see the 3M stock under remaining pressure for quite a while and we are certainly prepared to dollar cost average into a substantial position. We just like that dividend king very much.

Let’s come to our second stock buy, Victrex, which is a high quality industrial company as well.

Victrex is the world’s largest manufacturer of a high-performance polymer known as PEEK. The material was invented fourty years ago by Victrex and has some very special features. It can be easily be moulded into parts, giving that product the advantage of huge design flexibility and vast application possibilities. PEEK is resistant to friction, fire, chemicals, corrosion and electricity.

Over decades, Victrex has shown sustainable competitive advantages from a combination of strong brand, large scale, long experience and numerous patents protecting its very strong margins. Another attractive feature is its strong balance sheet. Victrex has a long record of growing profits and escalating dividend payments.

So, having added consistent dividend paying stocks of two strong businesses, we gave our passive income generation process another boost and came another step closer to hitting our USD 10’000 milestone in 2019.

What abot you fellow reader, have you added some new positions to your portfolio? Any nice dividend increases of your stock holdings?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Hi FS,

I have my eyes on 3M, too. However, as you noted yourself, 3M’s stock is not yet particularly cheap. I still sold 2 put options, but couldn’t convince myself to buy any shares yet.

– David

Hi David

3M is an amazing business, but it’s cyclical and showing slowing growth prospects with a slump in profit margins as well. I see price levels of around USD 160 only as a good entry point if one plans to build a larger position and will take advantage of further falling prices to significantly increase the stock count in the investment portfolio and to average down. My wife and I really like the company and have stood at the sideline quite some time and couldn’t resist to take a stake in that amazing company.

I wouldn’t be surprised to see much more attractive price levels which could show you an entry point where you will feel comfortable with.

Thanks for stopping by and commenting.