Hey there, fellow reader, glad that you are stopping by for our monthly passive income update. In this post, I will also share with you our newest stock addition to our investment portfolio, making our cash churning passive income machine stronger.

100 % dividend income boost compared to previous year

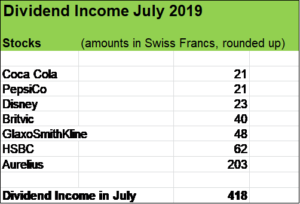

July was another terrific month in terms of dividend income. In fact it was one more month showing a year over year DOUBLE, jumping from USD 210 in July 2018 to USD 418.

From January to July 2019 my wife and I have collected over USD 8’000 in dividends (net after taxes and fees) which is pretty amazing, just thinking that so far on average my wife and I received USD 1’100 per month!

Receiving money, entirely passively, just for being shareholders of fine companies and collecting all these nice cash flows ready to reinvest and using the power of the compound effect. What’s there not to like?

There are still five months left, so we have some time to finally SMASH OUR 2019 FULL YEAR USD 10’000 PASSIVE INCOME GOAL.

We just can’t wait to hit that number as early as possible! Chances are good that we will be there by the end of September.

Receiving a FIVE DIGIT PASSIVE INCOME AMOUNT in 2019 will lay the ground for strong future growth and is a huge Motivation for us to CONTINUE to

- work hard,

- spend wisely

- invest conservatively and

- lead a down to earth lifestyle.

Now, let’s have a closer look at our July dividend income.

Compared to the previous year, there is one additional passive income contributor: the German private equity company Aurelius. We added stocks in in March 2019 for around USD 3’800 and recently received USD 203 in dividends (net after taxes).

Arelius as one of our new stock holding contributed almost 100 % to our YoY passive income growth in July.

Well, in general, what my wife and I want to see is passive income increasing due to a COMBINATION of

- organic growth (dividend hikes)

- dividend reinvestments and

- the addition of new funds into new or existing positions.

In terms of dividend hikes, July was as follows:

- Coca Cola: + 2.6 %

- Britvic: + 5.1 %

- PepsiCo: + 3 %

- Disney: + 4.8 %.

- HSBC: payout unchanged

- Glaxo Smith Kline: payout unchanged

So, organic dividend growth from our July contributors clearly has been below our average of 6 to 8 %.

Bank giant HSBC and Glaxo Smith Kline held their payouts steady. But with YoC of almost 10 % and over 7 % respectively, dividend reinvestments will increase our share count very nicely over the long run.

To some extent, July dividend results have been lowered by currency headwinds.

Our investment portfolio is denominated in Swiss Franc (CHF) and we have a significant portion in USD, GBP and EUR stocks. Compared to July 2018, the CHF strengthened against these three currencies by almost 3 % on average. As each of our July contributors were either in USD, EUR or GBP, that adverse currency movement (against the CHF) had a particularly strong effect.

Fair enough. On the other side, a strong CHF let’s us benefit when it comes to new investments (in USD, GBP and EUR stocks), so when taking a long term view, exchange rate fluctuations don’t have that much effect and will even out.

USD 4’300 investment in Tate & Lyle

Tate & Lyle is a British supplier of food and beverage ingredients to industrial markets.

The company’s history goes back 160 years. Originally, Tate & Lyle was a sugar refining business. But in the last decades it has been going through a significant diversification- and reshaping process, eventually divesting its sugar business in 2012.

Tate & Lyle specialises in turning raw materials such as corn and tapioca into ingredients that add taste, texture, and nutrients to food and beverages.

So for instance, when consumer staple giant Unilever or British soft drink maker Britvic want to reduce sugar of their soft drinks (like ice tea) to respond to changing consumer needs and – in the case of Britvic – to respond to sugar tax, Tate & Lyle helps these companies reformulating their products.

Replacing sugar or fat (e.g. in soups and snacks) to reduce calories is one thing, but the products have to maintain their taste.

Headlines such as “sugar reduction“, “fat reduction“, “changing consumer needs“, “healthier food” are important issues when it comes to consumer staple businesses.

Our investment portfolio has a strong exposure to that sector through our holdings in Nestlé, Unilever, Coca Cola, PepsiCo, Reckit Benkiser, JM Smucker, British soft drink makers Nichols and Britvic, beer giants Heineken, Anheuser Busch and spirit company Diageo. For my wife and me, these are all wonderful businesses. Some of them have to adapt to a “healthier food and drinks trend” and reformulate some of their products. And clearly, companies such as Tate & Lyle are very important partners for them.

What I like most about Tate & Lyle are the sound and conservative financial parameters. Over the last few years, the business has been deleveraging. We like good cash generation and robust balance sheets of businesses we invest in. Top- and bottom line growth of Tate & Lyle has been steady – and unspectacular, in a low to mid single digit range.

Dividend growth of the company has been pretty conservative. Over the last decade, payouts have been moving up nicely while the business has been maintaining a healthy payout ratio of roughly 50 %. Given a YoC of around 4 % with this new investment and the possibility to participate in the company’s Dividend Reinvestment Plan, we are happe to welcome that new passive income contributor to our stock portfolio.

Looking ahead

I am pretty confidend that my wife and I will surpass USD 10’000 in cummulated dividends by the end of September, which is for us a huge milestone. On top of that amount come roughly USD 500 interest income from corporate bonds. These investments are running off soon, freeing roughly USD 40’000 in cash. I’ve be thinking pretty hard on the most efficient use of these funds.

For my wife and me it has always been important to keep ample of cash. Not only to be secured in case of an urgency but always to provide as mach flexibility for our family as possible. What we always want is being able to take advantage of market opportunities when we see them. And I promised to my wife, that whenever we would see a nice house at a reasonable price, we will certainly consider buying it.

And of course, we will keep investing in our stock portfolio, which in the meantime has grown to a market value of almost USD 300’000. These are funds we will keep untouched for decades.

For everyone, the triangle between “liquidity”, “rentability” and “risk” is always an issue when it comes to investing. These three elements are “trade-offs”, for instance you cannot have optimal rentability with no risks and perfect liquidity. With interesting and profitable investments, funds have to remain in the productive assets some time, it’s not rarely that they need to compound over decades to give fantastic returns.

So, coming back to the USD 40’000 which in our case have been invested in bonds so far and will run off pretty soon. We have been thinking hard how to put that money to work efficiently with much better returns WHILE still have these funds available in a matter of few days.

As dividend growth investors, we love to invest in stocks. Our long term approach works very well for us and we will keep putting our savings into the stock market.

But not the mentioned USD 40’000. These funds shall remain as much liquid as possible while bringing some decent returns.

So we decided

- to use USD 10’000 to increase our cash pile, which means almost zero return and almost no nisk while providing the advantag of instant availability.

- The larger portion in the amount USD 30’000 will be put in an investment form, we have so far not used yet.

In fact, we will use USD 30’000 to set up a second passive income machine, which will – in combination with our stock portfolio – churn out fresh money each month. We’ve been working pretty intensively over the last weeks to build a robust new passive income machine. As always, when it comes to learning something new, it takes a lot of initial effort (reading a lot, assessing, comparing etc.). It takes time and patience. But once it’s running, it will work like clockwork, comparable to our stock portfolio “throwing” these nice cash flows to us each month.

I am looking forward to share with you our first results of our NEW passive income machine in my next blogpost.

So, stay tuned and thanks for reading.

Haw about you fellow reader, which passive income sources do you currently have (e.g. stocks, rental properties, P2P etc.)?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Congrats again to an awesome YoY growth rate! It’s amazing to see your passive income growing by such a fast pace, which is also a huge motivation for me to keep up my path to financial independence.

As said before many times, I’m always surprised about your new investment ideas. E.g. I’ve never heard of Tate & Lyle before, although this company sounds like a perfect match for my portfolio, too. So, I‘ll definitely run it through my stock screener asap.

I‘m also really excited about your new source of passive income, as I‘ve recently looked for alternative income streams myself.

– David

Hi David

Thanks for the kind words.

Yes, it’s for some time now, that we set some focus on smaller and medium-sized British businesses like Britvic, Nichols, Tate & Lyle etc. which are not necessarily on the radar of many investors but offer very attractive fundamentals in our view. Interestingly, some reading about businesses in our portfolio led to interesting names to put on our watchlist and have then be added to our holdings. e.g. PepsiCo was a larger shareholder of Britvic; Tate & Lyle is a supplier of Unilever etc.

With regard to our second passive income machine, yeah, it’s really exciting, I see a lot of potential and it’s also very super exciting to learn new things.

Appreciate you stopping by and commenting.

Cheers

Pingback: July Dividend Income from YOU the Bloggers! - Dividend Diplomats