Hey there, fellow reader, glad you are stopping by for a brief update on our key financial numbers (savings rate, total wealth) and our passive income generation.

Note: all number are in Swiss francs (CHF). CHF 1 corresponds to around USD 1.11.

Financial Highlighs in July

- Our savings rate climbed strongly compared to the previous month from 48 % to now 60 %.

- Our Wealth climbed by CHF 10’000 to a total of CHF 900’000 driven by stock market performance (while USD-devaluation against CHF was a headwind) plus robust savings from our day jobs.

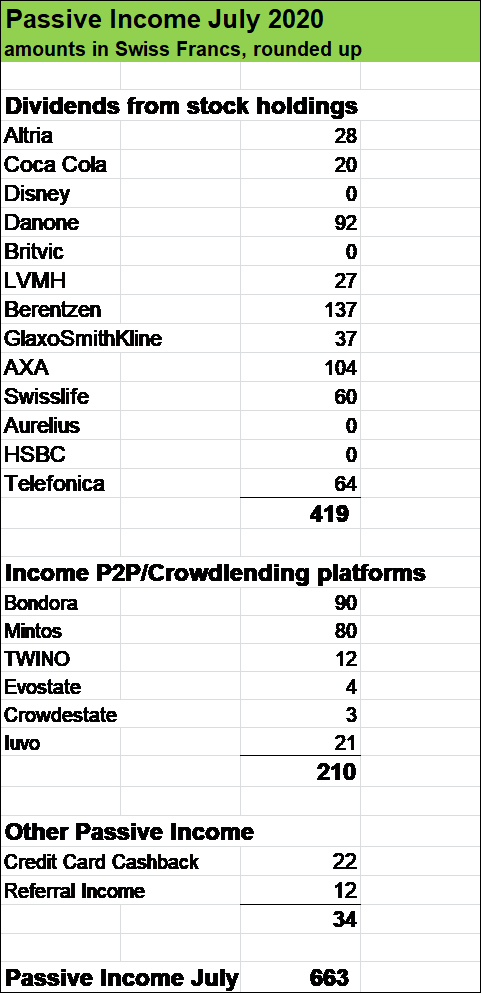

- Dividend income was stable compared to the same month in the previous year (CHF 418 vs. now CHF 419) While there were several dividend cuts which of course hurt, that adverse impact could be offset by new stock positions (tobacco giant Altria, drink maker Berentzen, insurance company Swisslife) which contributed nicely to our July results.

- Peer to Peer and Crowdlending Income was slightly lower than in the previous month (CHF 226 versus CHF 210).

- With CHF 663, our total Passive Income was 58 % higher than in the same month last year.

- In July, no new Stock Positions were added to our investment portfolio.

- Last month I started a Passive Income Challenge with the goal of adding one new passive income source each month. In June I added Cashback Credit Cards as an additional interesting income source and in July I added Referral Income which contributed in the amount of CHF 12.

I will write a separate blogpost on my Passive Income Challenge and share with you how I establish new streams of cash flow.

So, stay tuned.

What about you, fellow reader, how was your July in terms of Passive Income? Did you buy some interesting new stocks?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

I think it’s very cool + CHF 10’000. Congrats on a solid month.

Thanks Rick, yes we feel very blessed and will work very hard to keep that momentum.

Nicely done, especially the increase savings rate. We received over $2,300 in dividend income in July and feel very blessed for getting such big amount.

Many thanks Tawcan, yes boosting our savings rate gives us so much more flexibility.

Wow, USD 2’300, that’s a very nice July dividend income. Keep it up and thanks for swinging by and commenting.

Cheers

Like seeing that MO payment. I still like that stock despite the negative business they operate. Still can’t deny their cash flow. Keep up the good work.

Hey DivHut

Thanks for swinging by and commenting. Yes, indeed, these tobacco businesses still keep churning out cash quite nicely. I am not too heavily invested in that sector but to “spice to things a bit up”, its an interesting dividend play.

Cheers

MFS –

I love the passive income challenge. VERY interesting and fun!

-Lanny

I loved your blog and thanks for publishing this about July 2020 financial update chf 10000. I am really happy to come across this exceptionally well written content. Thanks for sharing and look for more in future!! Keep doing this inspirational work and share with us.One must check this Thekelleyfinancialgroup.com it gives us more info on this topic.