The COVID-19 pandemic brought huge health, social and economic challenges to the whole world and has a deep impact on our daily lives.

The pandemic also made businesses, educational institutions (schools, universities etc.) and other organizations all around the world more than ever depending on communication systems like Windows Teams, ZOOM or Slack. The pandemic also changed our buying behaviour, bringing consumers to e-commerce platforms provided by Amazon or Shopify. These developments have accelerated the shift to the cloud with services like Amazon Web Services (AWS), Google Cloud or Microsoft Azure which all led to a hue spike in internet traffic. This consequently has put content delivery network and edge computing companies like Cloudflare and Fastly in the forefront of a paradigm shift.

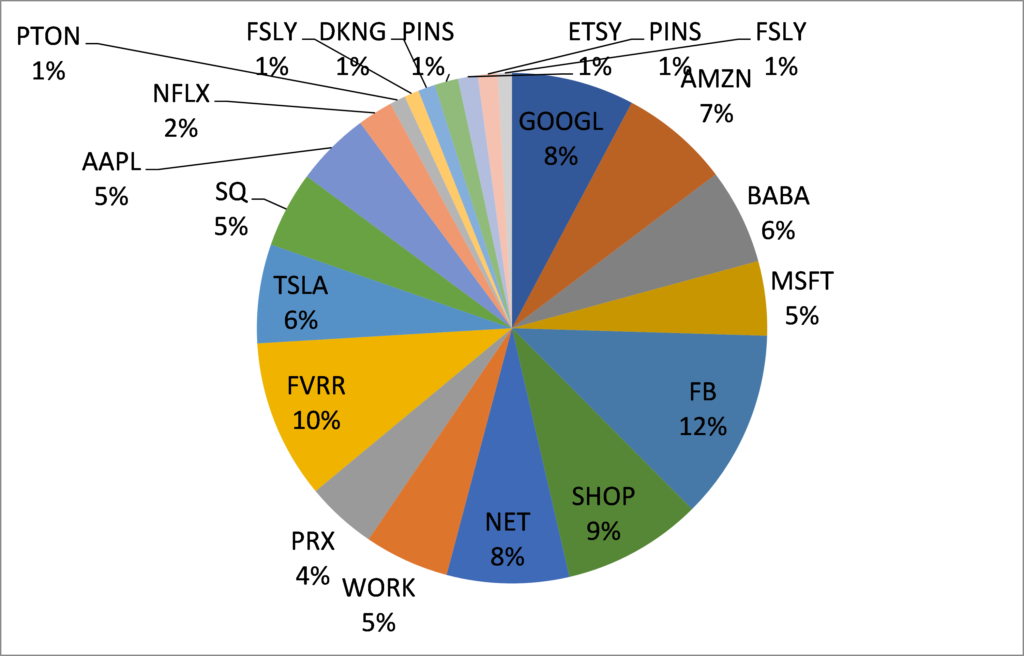

Amid all these huge shifts, my wife and I have been constructing a Tech Portfolio since April 2020. We want to buy winners, companies that are at the right time at the right place with superior long term growth prospects.

To be clear: we want of course continue holding our dividend paying value stocks like Nestlé, Coca Cola, Mc Cormick, Diageo, Heineken, Roche, GlaxoSmithKline, Allianz Insurance etc.

But we want to ensure to be well positioned by having a nice combination of Growth Stocks and Dividend Paying Holdings (whereas the ideal of course is the combination of both aspects in the same stocks such as the ones of Microsoft, Apple or Prosus).

All right, let’s have a look at our latest stock buys we made in the last two months in the total amount of USD 1’802 (this is inclusive commissions/fees):

- Pinterest (10 shares for USD 45.54 resp. a total of roughly USD 450)

- Fastly (5 shares for USD 86 resp. a total of roughly USD 430)

- Etsy (4 shares for USD 123 resp. a total of roughly USD 492)

- Draftkings (10 shares for USD 43 resp. a total of roughly USD 430)

Some background information on these four businesses.

Pinterest is creatively building a unique business platform

Pinterest is an image sharing and social media service designed to enable saving and discovery of ideas and information. If you want to find some inspiring images and creative ideas, Pinterest is definitively the place to go.

Pinterest also belongs to the largest and best known social media platforms among Facebook, Twitter, Instagram, Snapchat, Linked-In etc.

But with Pinterest, it’s much much mor than a social platform. It’s about connecting and sharing IDEAS. It’s about creativity and inspiration.

I cannot think of another platform that works the same way and therefore, I cannot think of any real competitor for Pinterest.

When users find something they like on Pinterest, they can pin those images to specific boards. The platforms’ algorithms then suggest more new pins based on the user’s interest and previous activities. And here lies the huge business potential because some of those suggestions can be advertising.

Pinterest as a company is relatively young, founded in 2010, the growth story has just begun. It’s operating in a huge and thriving market such as online advertising, and what we can be see is that Pinterest is increasingly venturing into e-commerce.

Fastly – a super fast growing content delivery, compute and security edge platform

Fastly is a competitor Cloudflare where we have initiated a position some months ago.

Fastly is smaller than Cloudflare, operating an innovative content delivery, compute and security edge platform. The company was founded in 2011 and has very strong partners and clients. That list includes names like Google, Shopify, Etsy, Pinterest, Slack, Microsoft, Vimeo, The ew York Times, Reddit, Stripe … and TikToc.

In fact, TikToc the Chinese video-sharing social network service (which is owned by ByteDance) is Fastly’s largest single customer, accounting for 12 % of revenues. Amid a looming ban from U.S. app stores, Fastly’s stock price got hammered in October.

When a businesses of the quality and potential of Fastly get’s 30 to 40 % “cheaper” due to rather temporary setbacks and uncertainties, well that catches my attention. I am more than happy to having initiated a small position and will buy more over time.

Fastly provides an edge cloud platform which is designed to help developers extend their core cloud infrastructure to the edge of the network and consequently closer to users. Fastly’s technology is essential for customers around the world, its edge cloud platform includes their content delivery network, image optimization, video and streaming, cloud security, and load balancing services. Fastly’s cloud security services include denial-of service attac protection protection, bot mitigation, and a web application firewall.

Etsy – a wonderful niche e-commerce website

Etsy is an American e-commerce website focusing on handmade and vintage items as well as craft supplies. You can find a wide category range, it includes bags, clothing, jewelry, furniture, toys, art items and alsow craft tools and supplies.

All vintage items must be at least 20 years old. The site follows in the tradition of open craft fairse, giving sellers personal storefronts where they list their goods for a fee per item.

What’s very obvious when going through the financial statements of the cmpany is that Etsy has found ways to effectively monetising its market place and that it has a very capital light business model. It’s operating in a niche, growing very fast, giving the company economies of scale and margin expansion.

When people sell on Etsy, there are various fees like listing fees, transaction fees, payment processing fees (if Etsy Payment is used) etc..

Draftkings, the largest fantasy sports and mobile sports betting operator

DraftKings is an American daily fantasy sports contest and sports betting operator.

It’s quite an interesting concept and business model. DraftKings allows users to enter daily and weekly fantasy sports-related contests. The users can win money based on individual player performances in sports (baseball, football, hockey, basketball, golf, tennis, martial arts, auto racing etc.).

So how does fantasy sports work?

In fantasy sports, users can create their own teams which are real players of a professional sport like tennis, football or basketball. Players may be from existing leagues (NFL, NBA, NHL, MBA etc.) or even college teams.

And how does DraftKings make money?

The company makes money off player entrance fees. For example, DraftKings may collect a fee resp. a percentage from users who pay for league buy-ins. The main amount from each user is placed into the pool, which is paid out to the winner at the end. DraftKings also makes money by selling ads on their sites and partnering with other big names like NBC, Sports Illustrated, Comcast, and Sporting News.

DraftKings is the clear leader in an interesting, growing niche and the platform is a beneficiary from economies of scale and network effects.

Several U.S. states consider fantasy sports (including daily fantasy sports) a game of skill and not gambling. There are some risks as well as opportunities from changes of regulations resp. legislative requirements.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply