30 % more Dividends

When I started the blog My Financial Shape back in 2016, documenting the journey of our family of four towards Financial Independence by 2024, my wife and I set a strong focus on increasing our Savings Rate in order to invest on a regular basis.

We had been building a dividend portfolio for a few years before and been tracking all cash inflows we got from our investments.

It’s vital to establish different Passive Income Streams and diversify them over time.

We wanted to bring ourselves in a position where we would never “need a job” again.

So, we worked hard to shape our finance, cut costs in order to achieve a savings rate of at least 60 %, building a nice cash pile and invested regularily into dividend paying stocks. We focused on solid businesses that provided us with a reliable stream of dividend income. Companies like Nestlé, PepsiCo, Heineken, Coca Cola etc. were constantly on our watchlist and whenever markets fluctuatied, we took advantage to enter into many stock positions.

Our path as Dividend Growth Investors has paid off handsomely so far. It’s amazing, how slowly, but surely, our Dividend Income has been marching up over the years (all numbers are in Swiss Francs CHF), which correspondes to around USD 1.1; all numbers are always net after taxes).

But then, in 2020, during the COVID-19 Pandemic cash generation from our investments has been hit quite substantially. Even wonderful businesses like Disney, French luxury giant LVMH or British soft drink makers Britvic, Nichols and Ag Barr completely scrapped their shareholder payouts. Many others businesses in our stock portfolio drastically reduced their shareholder payouts which led to a 13 % lower dividend income compared to 2019.

Interestingly, one year later, our Dividend Portfolio is recovering quite nicely.

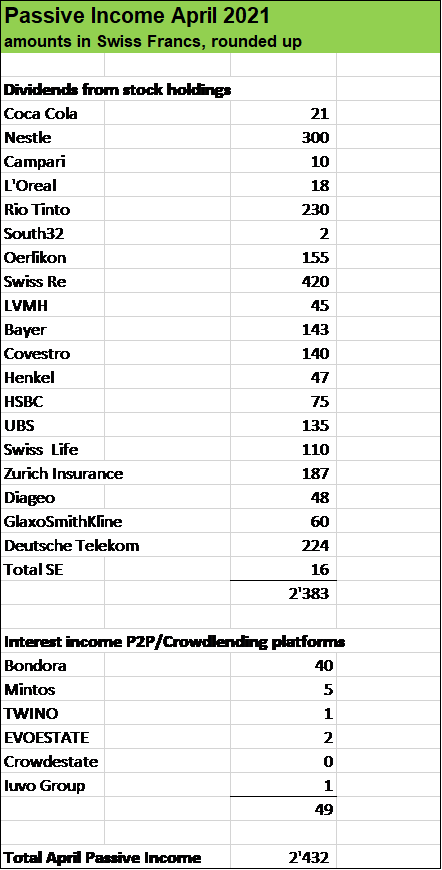

Compared to April 2020, our Dividend Income jumped by 33 % from CHF 1’800 to almost CHF 2’400. This increase was mainly due to organic growth and the fact that several companies resumed their dividend payouts such as British bank HSBC, LVMH.

Our second Passive Income Machine consisting of Peer to Peer and Crowdlending Investments generated significantly lower interest income compared to the previous year (currently CHF 49 versus CHF CHF 413). This was due to substantial cash withdrawals we have been during 2020 to build up our Tech Portfolio.

So, we are quite happy with our total April Passive Income in the amount of CHF 2’400 which brings the number to CHF 4’520 resp. to CHF 1’130 on average per month.

For the full year, we want to achieve at least CHF 15’000 in Passive Income which currently looks quite achievable.

What about you, fellow reader, how was your April in terms of passive income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Nice looking month, My Financial Shape! Congrats on the 33% increase. That’s a great collection of businesses you have there. It’s motivating to see what you’ve done with a high savings rate. Looking forward to future reports! 🙂

Thanks Graham, for your kind words and for swinging by. Yes, it’s a relieve to see our dividend income return to growth after that blow in 2020 due to the pandemic. We will work hard on streamlining our savings rate further and adding high quality businesses to our “Passive Income Machine” to increase the positive momentum.

Happy investing and thanks for stopping by and commenting.