With the third quarter 2021 in the books, let’s have a brief look at the September Passive Income Update:

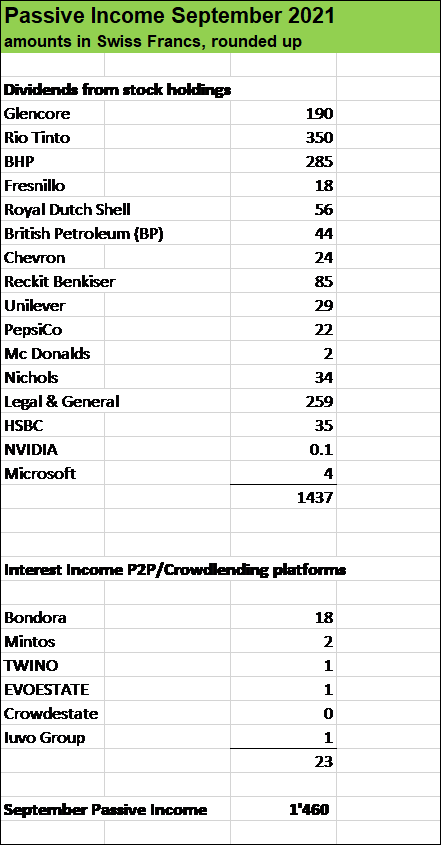

- Swiss francs 1’460 (CHF 1 = USD 1.1) versus CHF 1’200 in September 2020 , an increase of 21 % Year over Year (YoY).

- In the past nine months, over CHF 10’600 resp. USD 11’700 have been collected in passive income which represents a 78 % achievement rate with regard to our 2021 USD 15’000 goal.

- The past nine month cummulative passive income is already 12 % higher than the one for the whole 2020.

- Last year, mining giant GLENCORE had cut the dividend but has now resumed its shareholder distributions. Anglo-Australian peers Rio Tinto and BHP group significantly hiked their dividends compared to the previous year, contributing to the nice uptick on a YoY basis

- Royal Dutch Shell increased its dividend by 38 % compared to the previous quarter, but still some way below the amount it paid aout before the pandemic. Royal Dutch Shell has been in my portfolio since 2009 and returned almost 90 % of the purchase amount I paid back then in dividends. But clearly, investing in high yield stocks can by tricky.

- British Petroleum (BP) increased its dividend by 4 % which is a welcome boost, after the company haved its shareholder payouts in 2020. BP plans to maintain its dividend growth rate in a range of 4 % per year until 2025.

- Insurer Legal & General increased distributions by 5.1 % and its peer Aviva by 37 %. Aviva however will made its payout in October whereas last year the the second semester payout was made in September. So, without these dividend date changes there would even be a higher September passive income.

- British bank HSBC giant resumed its dividend payments in the third quarter, after having stopped shareholder distributions amid the COVID-19 pandemic.

- Microsoft hiked its dividend by over 10 %. Its not a strong dividend contributor but has provided my Tech Portfolio with a nice growth element and a very nice book gain (Microsoft shares bought in 2020 for around USD 2’000 have now a market value of over USD 3’000).

- NVIDIA pays me just around 10 cents quarterly dividend, but this position is an excellent growth contributor with a lot of potential in the future. I bought one share months ago for less than USD 500 and after the stock split I am sitting on 5 shares with a market value of over USD 1’000, a nice double of my investment.

- Our dividend stock portfolio as well as the tech holding portfolio are near an all time high due to substantial book gains. The combined market value stands at around USD 460’000 in company shares. Adding our Peer to Peer and Crowdlending investments (Bondora, Mintos, Iuvo, Twino, Evoestate, Crowdestate) and some corporate bond positions as well as my Crypto Portfolio, we have around half a million invested in various assets classes.

What about you, fellow reader, how was your September in terms of Passive Income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Leave a Reply