Happy New Year to everyone!

It’s been quite a while that I’ve published a new blogpost on my blog My Financial Shape. In fact, my latest update was in April 9, 2023!

So, my full year 2024 really is more than due.

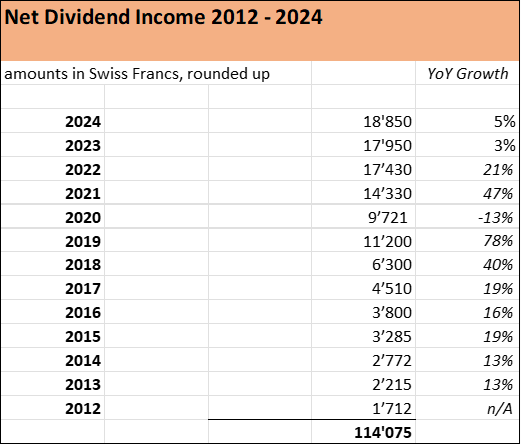

I’ve been building my dividend stock portfolio for almost 14 years now and as you can see, the dividend income increased quite nicely year by year. Of course, there have also been some setbacks, for instance in 2020 during the COVID pandemic, several companies cut their shareholder payouts. But all in all, the compound effect really shows, fueled by a combination of

- dividend increases (“organic dividend”)

- dividend reinvestments and

- addition of new stock positions or increasing existing share positions

As of today, my stock portfolio has a market value of well above USD 650’000, almost 35 % consists of tech companies and only a few pay dividens such as Meta, Alphabet, Microsoft, Apple, NVIDIA, Prosus and ASML. Insurance businesses (Swiss Re, Münchner Rück, Zurich Insurance, Legal & General etc.) and resource companies (Chevron, EXXON, BHB, Rio Tinto etc.) have been the main dividend contributors for the last years.

The main reason for slower dividend income growth in the last two year were significantly lower savings rates in 2023 (18 %) and 2024 (12 %) which led to lower investments into publicly traded stocks compared to previous years. I have also reduced historically strong European dividend payers over the last 18 months and shifted the focus more on US tech stocks. As said, most of them don’t pay dividends but offer great growth opportunities.

Adding interest income (from bank savings, bonds and Peer to Peer investments) of around USD 2’000 to my total passive income in 2024 total net revenue stood well above USD 20’000, covering around 30 % of the total annual spendings (rent, grocery etc.) of our family of four.