Establishing solid passive income streams is the first step to set a compounding machine in motion, putting us more and more into a position where we are less and less reliant on our daily jobs.

As long term oriented Dividend Income Investors, shareholder distributions from over 60 stock postions have been our main passive income sources in the past years, together with interest income from corporate bonds and Peer to Peer and Crowdlending Investments.

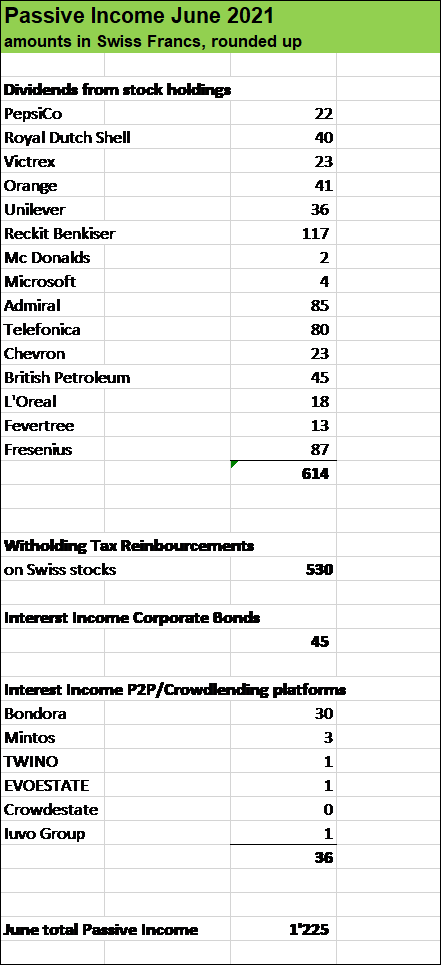

In June, roughly Swiss francs (CHF) 1’225 (USD 1’350) have been generated by our investments. Roughly 18 % lower compared to the same month in the last year. This was soleley due to one technical aspect: British insurer Legal & General – one of our largest divident payer (contributing almost USD 600 per semester) – last year made its semestrial payout in June while in 2021 that payout has been made in May.

For 2021, we set our target of at least USD 15’000 in total passive cash income.

Let’s look at the first semester 2021. In the first six months of 2021, over Swiss francs (CHF) 8’700 have been generated from our investments, corresponding to around USD 9’721. So, almost 65 % of our annual target has already been achieved.

Compared to the first semester 2020, we saw a very nice Year over Year increase of roughly 37 % amid several stock positions having resumed their dividend payouts. In the first semester 2020, we also had to make a write-down of over USD 2’000 due to the collapes of two Crowdlending Platforms (Kuetzal and Envestio) I had invested in. That write-down very negatively impacted our 2020 annual passive income results which stood at around USD 10’000.

But 2021 will be significantly stronger and our passive income sources as a group are now much more diversified and more resilient.

So, as for now, it looks very realistic to smash our USD 15’000 annual passive income goal, which sets us one step further towards Financial Independence which we want to achieve by the end of 2024.

How was your June in terms of Passive Income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Félicitations pour tes dividendes du mois de juin de 1225 francs suisses Financial Shape ! 🎉💰😃👌 C’est vraiment bien, tu es déjà fait 8700 francs suisses lors de tes premiers six mois, wow, assez impressionnant quand même ! 👏👏 Merci du partage, car je ne suis pas trop familier avec les compagnies européennes qui versent des dividendes! Lâche pas, tu es assurément sur la bonne voie l’ami pour battre un record cette année !

Salut Dividendes & FNB

Oui, on est vraiment heureux que notre portefuille ait retrouvé le chemin de croissance concernant les dividendes. USD 15’000 (environ CHF 13’500) est un but qu’on pourra attaindre pour 2021. On aime beaucoup les titres Européens qui n’étaient pas chers pendant des années et en terme de dividendes ils sont toujours asses attractifs.

Merci bien d’avoir lu mon article et d’avoir écrit un commentaire. Beacoup aprécié!

Pingback: Dividend Income from YOU the Bloggers! – June 2021

Hey Dividend Diplomat,

Thanks for swinging by and for including my on your Blogger Dividend Income Update! Yeah, I am really glad to see again robust dividend income growth, after a tough 2020. My full year goal of USD 15’000 is in full sight! Already looking forward to hitting that milestone.

Cheers