The key ingredience to your financial wellbeing

Sometimes I hear people say that achieving Financial Independence is only for people with

- either great wealth,

- and/or a very high income job,

- or an extremely frugal lifestyle,

- and/or particular investment skills,

- or a great deal of luck in life (e.g. a windfall which would put these people financially in a positon so that they can leave their job).

Over the last decade, I have been extremely interested in personal finance in general and in the topic Financial Independence Early Retirement (FIRE) in particular.

That’s why I have started this blog to document our path to Financial Independence by 2024 and sharing our experiences along the way and giving tips on various topics such as

- how to boost your savings rate and

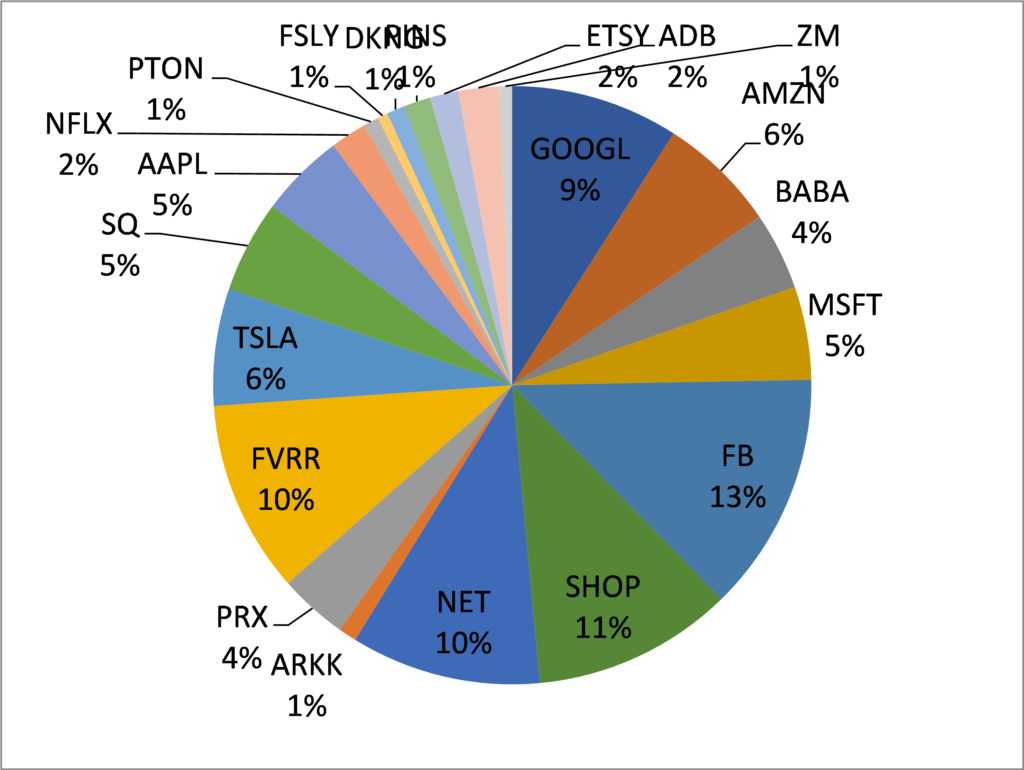

- to share ideas how a dividend portfolio or tech portfolio could be constructed etc.

From my own experience and from what I have read over the last decade, pursuing Financial Independence is certainly not just for millionaires. In essence, it all buils down to

- putting in place a systematic approach to shape and optimize your household’s finances over time and

- to invest regularily, consistently and long term oriented into income producing high quality assets such as dividend paying stocks.

By the way, I am referring here to a household’s wellbeing in general. Not everyone wants to achieve Financial Independence.

But in case you want to become financially independent in 10 to 20 years, that’s perfectly possible. Yes, the higher your wealth and/or your salary is, the easier it might be.

But here’s the catch: I high income could also make it even harder.

Why is that?

Because high income households are quite “vulnerable” to a Creeping Lifestyle Inflation (read here How Lifestyle Inflation takes your freedom).

On MyFinancialShape I often write about establishing an ever growing passive income stream by investing into dividend paying stocks such as Nestlé, The Coca Cola Company, PepsiCo etc. I document our monthly cash flow streams from our investment portfolios. I write about some of the best long term dividend stocks, about dividend reinvestments and on taking advantage of the compound effect to accumulate substantial wealth over time.

But in essence, when we are talking about achieveing Financial Independence, it really just boils down to the Savings Rate.

The Savings Rate tells you

- how much you are able to keep from your income.

- And it tells you in how many years you will be able to be financially free (read here: A 60 % savings rate is a real turbo).

Tracking, analysing, streamlining and optimising the cost structure is key.

A positive Jaws Ratio reduces risks, enhances profitability and flexibility

Mister Money Mustache wrote a brilliant article with the title Frugality as a Muscle. I highly recommend his blog in general and to have a look at that article in particular.

Here’s your “workout to gain financial muscles” that I would recommend:

- know all your cost positons;

- write them down, track them month by month in an excel sheet;

- group the positions into fixed costs blocks (such as insurances, rent etc.) on one side and discretionary spendings (such as holidays etc.) on the other side;

- analyse all cost positons and assess whether you could optimise them without significant disadvantages (these are the low hanging fruits);

- discretionary spendings often can be influenced immediately but make sure you are cutting costs for things that don’t mean much to you;

- get creative, many spendings positons could be altered quite easily (e.g. insurance shopping, improving costs by comparing, negotiationg, changing);

- But always keep in mind: it’s absolutely important to remain motivated and enjoy the path toward Financial Independence as its a long term goal

- tackle in particular the fixed costs because once they are streamlined, there is a recurring benefit. Fixed costs are always to the detriment of a household’s financial flexibility, as it takes most often six to 12 months to have an influence on them.

- know all your income sources, track them monthly and work on adding passive income sources to them, diversify your cash flow streams over time.

- And last but not least on the list: apply the Jaws Ratio Concept!

If you know your cost structure you can optimize it over time and even plan your spendings.

You get full control over your financial life. You then have created options. You have then a tremendously strong position, for instance towards your employer. That’s what sets you apart from the majority of people.

And here’s another point: if you can change your total costs faster than your income dynamic, then you are so much better off than litterally anybody you know.

And here comes the Jaws Ratio Concept which can have a life-changing effect.

I wrote an article How to use Jaws Ratio to improve finances some years ago. On how that concept – which originially has been used in the context of corporate finance and security analysis – could (and should) be applied in personal finance to optimise a household’s financial position over time. If you haven’t read that article, I would definitively recommend to have a look at it.

The Jaws Ratio tells you whether your income grows faster than your spendings or the other way around.

You can calculate it with the following formula:

Jaws Ratio = Income Growth Rate – Expense Growth Rate

The Jaws Ratio can either be positive or negative depending on whether the income increase surpasses the expense increase or not. A positive result means that income grew stronger than expenses and therefore profitability increased.

I know people that got a pay rise, got promotions year after year which led to fast growing income. The savings rate was shooting up. But make no mistake: an increasing savings rate does not necessarily mean that your personal finances are healthy.

Here’s the flipside these people are often confronted with: if spendings have been climbing at a faster pace than income, then the household is in a very risky position.

As we all know, cash income streams can abruptly change, they can plummet dramatically or even stop completely. Just think of losing your job.

Income streams can all of a sudden dry out and litterally go to zero. By the way, that’s also why it’s important to have Passive Income Sources and diversify and strengthen them over time.

But costs always remain. It’s pretty tough cutting spendings in a matter of a few weeks, but it is completely feasible doing so over the medium and long run. As said, frugality is like a muscle which can and should be trained.

My wife and I have been applying the concept of Jaws Ratio for years. For instance, we reduced our work pensa from 100 % to 80 % while still keeping a more or less unchanged savings rate.

That was possible because we managed to slash our costs by more than the reduction of our work incomes. A 20 % salary drop should be accompanied by measures that lower the cost basis by at least 20 % which results in a Positive Jaws Ratio.

A Positive Jaws Ratio signifies

- improved profitability of the household,

- more flexibility and

- also a lower risk profile.

But in contrast, when costs climbe faster than cash income streams that results in a Negative Jaws Ratio. It’s then vital to detect such a development at a relatively early stake and take measures. That’s why, the Jaws Ratio Concept really is so essential.

So, just track for each year, whether your income has been moving in line with your spendings. If that’s the case, put the process forward, make sure you always have a Positive Jaws Ratio and you are are seeing your journey towards gaining financial flexibility put on autopilot.