Hi there. Appreciate you stopping by!

Let me ask you a question.

Would you invest in a business that makes USD 100’000 in revenues and grows that amount by 10 % annually?

“Yes, if the price is right” you might answer. Investing in a growing business can make a lot of sense, after all such a revenue growth rate is to some extent an indicator that the business offers good products or services to its customers.

Fair enough.

And what would you say if the annual overheads of that company were USD 90’000 and grew by 12 % every year alongside with the revenues?

Hmm. Not so attractive anomymore, am I right?

The reason is quite clear and intuitive: although that company is able to consistently increase revenues by a remarkable annual rate of 10 %, profits are squeezed year by year as costs grow even faster. Such a business is not attractive as an investment. It is pretty clear, that the fundamentals of that company are leading to losses, eroding shareholder value over time. The prospect would be daunting. After just a few years, dividend payments would be cancelled or slashed or – even worse – be financed with additional debts which is to the detriment of the financial flexibility and risk position of the business. The compelling revenue growth of 10 % in our example came at very high costs and sooner or later such a company would be out of business.

Companies are considered to make profits

As an investor, you are primarily interested in “your” company to make sustainable and growing profits. That’s the way shareholder value is created and increased over time. Successful companies (such as Johnson & Johnson, Coca Cola, Nestlé, Walt Disney) have a certain “financial behaviour”. For decades, they

- focus on making sustainable and growing profits

- tend to increase revenues faster than costs in order to boost profits

- consistently reinvest a portion of their profits to grow their business, improve products and processes and to make acquisitions

- use the power of the compound effect to their benefit

- invest in productive assets in order to increase their economic moat and ensure increased future profits

- focus on business oportunities, new products and services to establish new sources of income to make profits

- take on debt to grow their business and increase financial flexibility

- pay out between 30 % to 60 % of the profits to the shareholders in form of dividends and/or by buying back shares of the own company

Profits are the essence of successful businesses and consistently being reinvested make these companies real compounding machines. The difference between revenues and costs should be as wide as possible and – ideally – grow over time.

Households are considered to earn as much as possible in order to consume

The equivalent of profits in terms of households are their savings, defined as the difference between income (take-home-pay etc.) less spendings.

Interestingly, people have a different measure of success, when it comes to households and their personal finances. While companies are considered to make profits, individuals are generally considered to

- work hard

- be ambitious and loyal employees

- rely on having/getting a well paid job

- earn as much money as possible

- feel good at spending money and showing their consumption habits

- invest only a minor part of their income in productive assets such as stocks

- rarely take profit of the compound effect

- take on debts to invest in just one asset class wich is in general their house in which they live (therefore that investment is not productive)

So, the focus of households is quite different from companies and is set on the renumeration for working hours and consumption. Or just simply put:

“One earns to spend”

Both – businesses and individuals alike – are considered to manage resources efficiently and handle economic risks. But more often than not, households act irrationally when it comes to their finances. High consumption is perceived as a “successful lifestyle”.

Just let’s take a highly paid executive for example, making USD 500’000 annually and getting a pay rise of 10 % every year. The general perception is: “he or she made it” – Right?

Most people wouldn’t even change their perception, if they knew that our highly paid executive took a mortgage of USD 1 Mio. to finance the house and yearly spendings accounted for USD 400’000 annually and are set to grow by 12 % each year. Savings are eroding year by year finally turning negative in the medium term. What’s the result? Accumulated wealth will decrease and finally additional debts have to be taken on to sustain the lifestyle level. High consumption is litterally eating away the savings of the highly paid executive putting him or her in a financially risky position.

Remember, if a company showed these financial fundamentals, no one would consider an investment in such a business as it would be considered as unattractive. Just think of it: the mortgage by far exceeds ten times the yearly savings of the highly paid executive. A company with debts higher than three times yearly profit is already considered as highly leveraged and risky. Rating agencies such as Moody’s, S&P and Fitch wouldn’t even consider a company with such fundamentals investment grade.

Although the highly paid executive in our example arguably and objectively is in an uncomfortable financial position, few people would see it that way.

High income and high consumption of individuals are considered as measures of success

Why is that?

In my humble opinion, it is deeply rooted in our society and part of our education system and worklife. We are consistently trained to be good, loyal and ambitious employees and in exchange we are put in a position to consume. “The more the better”.

What’s the problem with consumerism and depending on a job?

Someone who works hard just to spend most of his or her income is caught in a ratrace and is in a very risky position. There is usually just one source of income. People depend on a specific job and more often than not on an increasing income level to keep pace with their “standard of living”. It is very hard – and sometimes impossible – to change high fixed lifestyle costs in the short run. Taking a position with a lower income level e.g. to work on something he or her is passionate about would be perceived to be to the detriment of the “standard of living”.

Escaping the ratrace

Consumerism is not per se a bad thing, but it can make you stuck. You don’t have many options. How can you lead a voluntary life if you exist from paycheck to paycheck? It’s impossible to truly pursue your dreams and rise to the top of your capabilities.

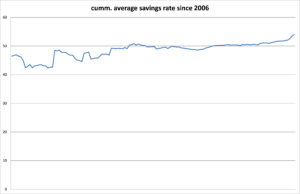

You should save. As much as possible and as much as you feel good about and even increase your savings rate over time. After all, that’s what successful companies do. They increase profits, they grow, they thrive financially.

So should you.

Aim for a higher savings rate to streamline your finances and to gain financial flexibility.

Invest in productive assets, diversify your income streams and put your money to work for you instead of the other way around.

Make money your friend.

Autumn dawns (painting by the author)

Autumn dawns (painting by the author)