When I started my personal finance and investing blog MyFinancialShape back in 2016, I not only wanted to document and share our Path Towards Financial Independence by 2024, but also to provide my readers with tips and inspiration on topics like

- how to improve the cost structure to boost the savings rate (for instance by using the Jaws Ratio Concept),

- how to construct a dividend paying stock portfolio and also

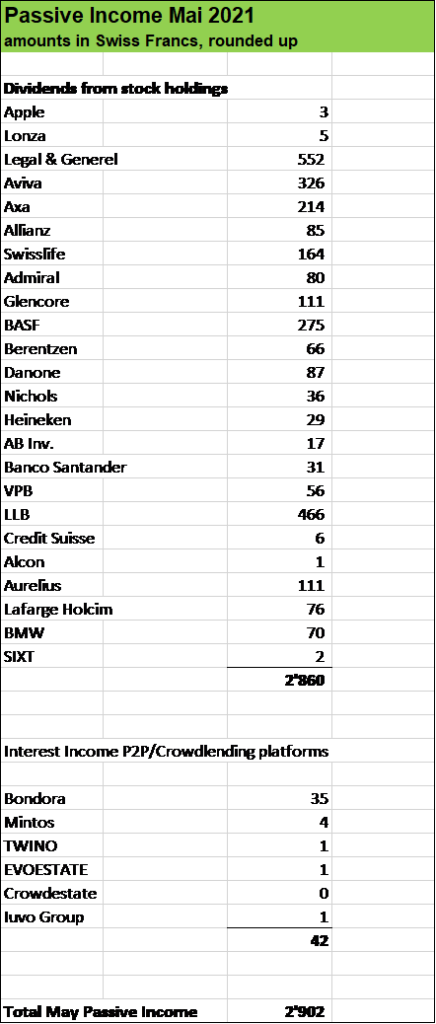

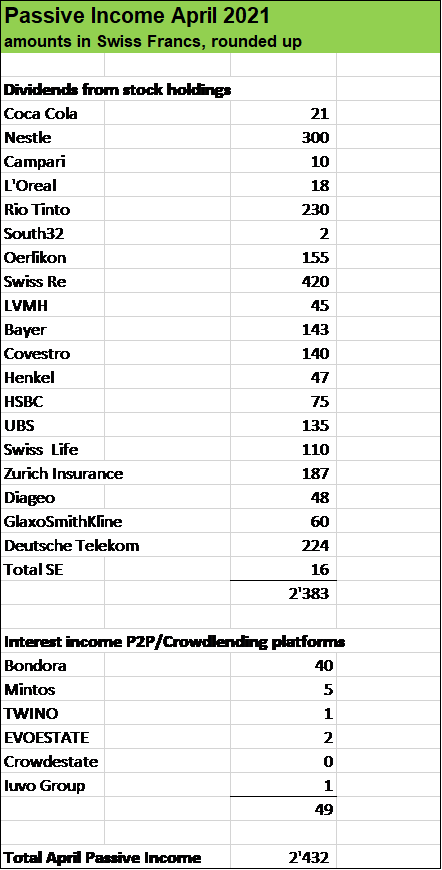

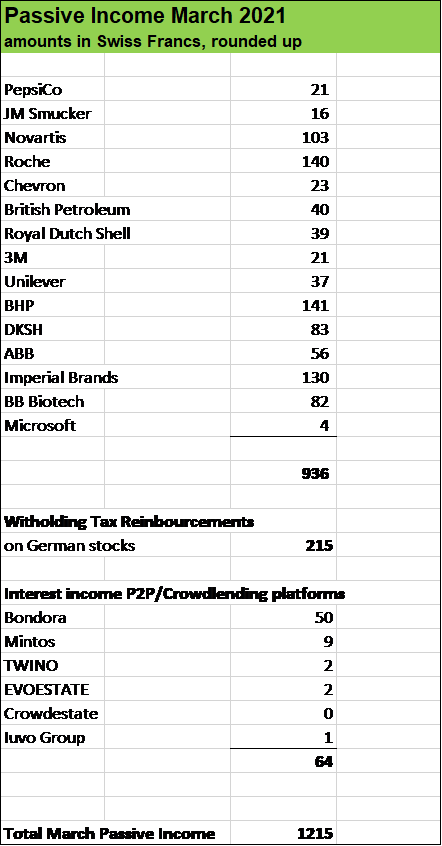

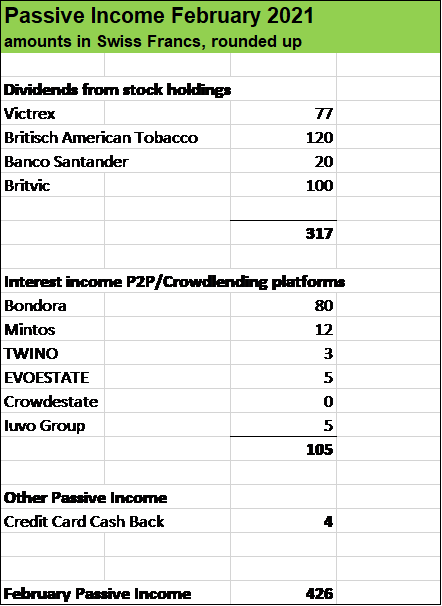

- to show the passive income generation of such a portfolio each month.

The purpose of MyFinancialShape is also to show that it’s actually possible to achieve Financial Independence (FI) and that in the end, it all boils down to the savings rate (wich determines the number of years to achieve FI). I also want to show how a consistent investment process pays off over the long haul. The compound effect works handsomely for long term oriented Buy and Hold Investor.

When the COVID-19 pandemic hit the world in 2020, our dividend stock portfolio lost almost 30 % in a matter of a few days. It has recovered handsomely since then. Our investment approach was tested and showed to be robust. We have been in a position to put our cash pile to work at market bottom to further strengthen our Dividend Portfolio.

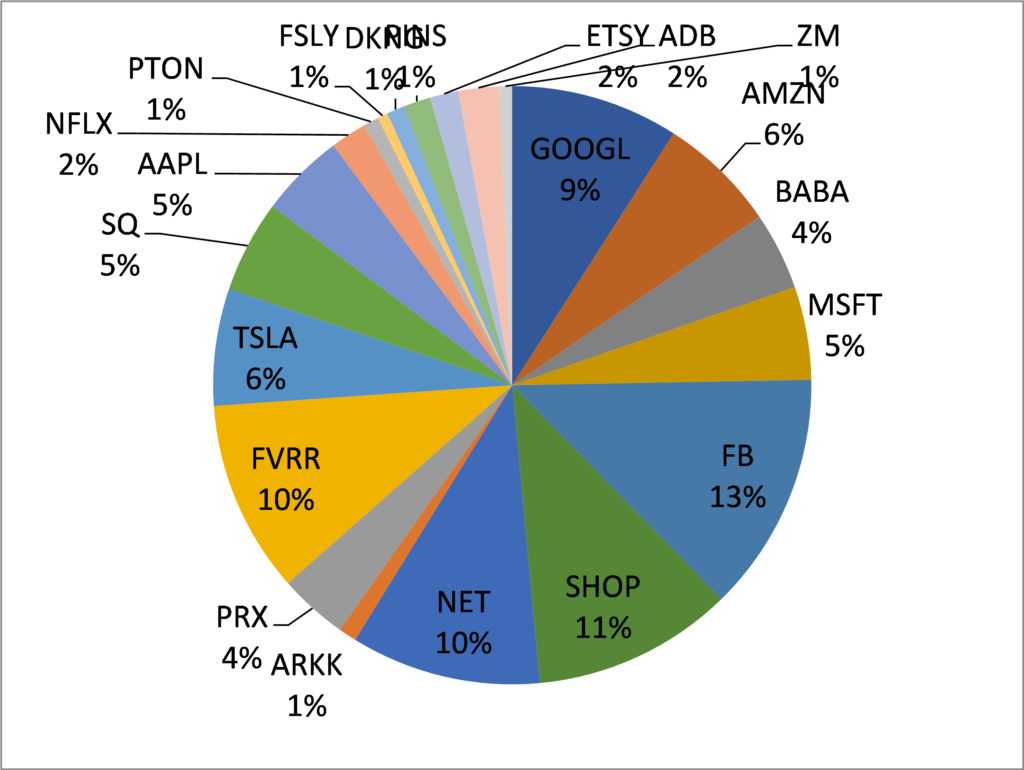

But most importantly: April 2020 marked the beginning of our Tech Portfolio which today consists of 25 positions and has returned over 62 % since then. You can find here a Snapshot on these Tech Positions.

My Tech Growth Portfolio has a different purpose compared to the Dividend Portfolio, which should generate increasing passive income.

What I expect from Tech Stocks is to generate over time substantial book gains plus having the prospect of becoming strong dividend payers in future. Alphabet (GOOGL) and Facebook (FB) for instance could easily be very generous with shareholder distributions a few years from now.

As Dividend Growth Investors, we need to have a long term perspective and build up future income sources. And I want to participate in the long-term growth trend of the digitalization of our economies.

As you can see from the pie chart above, the my five largest Tech Stock postions are:

- Facebook (13 %)

- Shopify (12 %)

- Fiverr (10 %)

- Cloudflare (10 %)

- Alphabet (9 %)

My Tech Portfolio developed quite well although I was very late to Growth Stock investing. For over a decade I have focused on dividend paying stocks, in particular in the consumer staple sector.

Which has proven to be just fine. But it’s never too late to adapt a strategy and give it a more dynamic shape.

I hope, my article provides you with some inspiration on how you can build up your own portfolio. Let me know in the comments below what you think.

Thanks for reading and sharing your thoughts.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.