Hey there, fellow reader. With another month in the books I’m glad to share with you an update on the latest financial developments and investment moves, bringing us further on our Path Toward Financial Independence by the end of 2024.

In particular I wanna show you

- our asset allocation in May,

- our savings rate,

- Passive Income Generation from our dividend paying shareholdings as well as from our Peer to Peer (P2P)/Crowdlending (CL) Investments and (we target USD 20’000 in Passive Income for 2020) and

- our recent stock acquisitions.

Finally, I want to give you a brief update on our Big Real Estate Project (acquiring rental properties in France).

Total Wealth jumped to USD 872’000 in May (April: USD 850’000), driven by strong stock market performance and robust savings

The reopeninng of businesses all around the world having been temporarily shut down amid the COVID-10 pandemig positively impacted the sentiment of international stock markets which also got a strong boost by very supportive monetary policy of Central Banks.

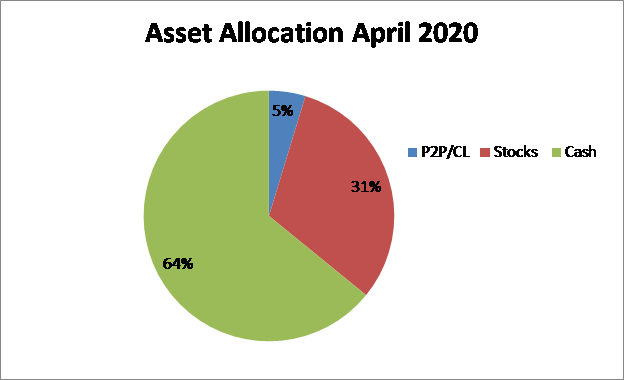

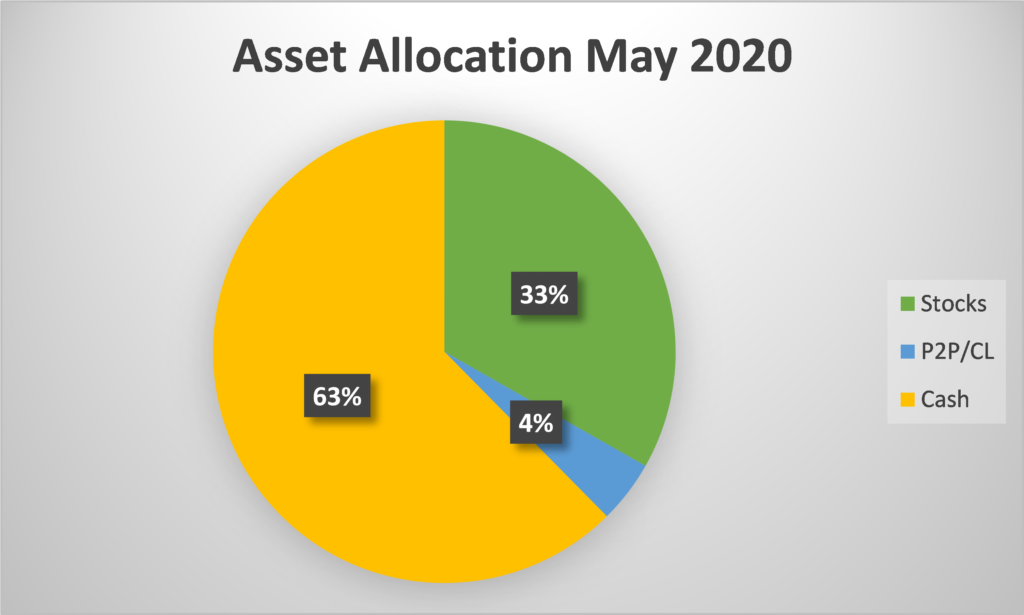

Let’s have a look at the pie chart showing our Cash Positon, Stock Portfolio as well as our Peer to Peer and Crowdlending (P2P/CL) Portfolio.

Our Share Portfolio accounts for 33 % of total wealth, up from 31 % (in April). The total market value of our investment portfolio increased by USD 22’000 to USD 288’000. We have over 60 stock positions which represent our FIRST PASSIVE INCOME MACHINE.

Stock markets had recovered quite nicely by the end of May which helped moving up the market value of our investment portfolio by USD USD 13’500, furthermore my wife an I invested over USD 8’500 (see lateron in this post) into new stock positions.

Our Cash Pile (money on bank accounts) grew by USD 1’000 to 541’000, representing 63 % of total wealth, more or less unchanged compared to the previous month. As said, we invested USD 8’500 into very interesting four new stock positions, these investments were mainly funded by our regular savings from day jobs as well as from our passive income of the previous month. We also made further cash withdrawals from our P2P/CL portfolio in the amout of USD 2’000.

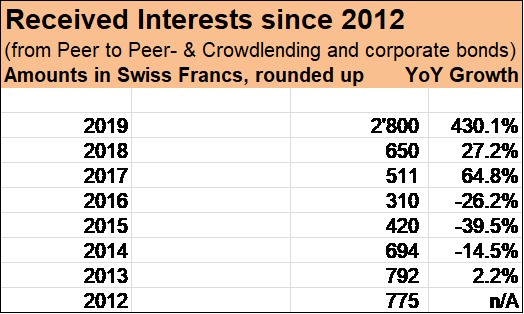

Our P2P/CL Portfolio now makes around 4 % of total wealth, down from USD 40’000 in the previous month to USD 38’000 by the end of May. That amount represents half of what we had invested in that asset class by the end of 2019. Our P2P/CL Portfolio is our SECOND PASSIVE INCOME MACHINE and will continue to play its role. But the COVID-19 pandemic, the lock-downs and the huge recession we all face brought us to the decision to scale back our Second Passive Income Machine.

Peer to Peer – and Crowdlending represent a relativ new and extremely interesting asset class but also with substantial risks. Currently, we consider the Risk-Reward-Profile of Stocks as more attractive, that’s why we prioritize the build-up of our share portfolio over our P2P/CL portfolio.

Over the last few months – in particular since the start of the COVID-19 pandemic – my wife and I set a strong focus on increasing our cash balance while keeping investing in stocks and taking advantage of interesting opportunities.

Stock markets all over the world recovered quite a bit from their March lows. But make no mistake: we are not out of the woods, there are huge challenges and recovery will be a bumpy – and painful – road.

One reason why my wife and I like to have a large cash pile is because it gives us financial stability and flexibility amid huge uncertainties. And we want to seize investment opportunities. May was another dynamic month in terms of stock purchases. We invested USD 8’500 into three Big Tech Names plus into one more consumer staple stock. I will get into our specific share buys lateron in this blogpost.

My wife and I also want to buy real estates very soon which should be our Third Passive Income Machine.

Savings rate 50 %, down compared to the previous months

Our consumption increased quite significantly compared to March and April which showed much higher savings rates (of 73 % and 78 %). Lock-downs have been lifted and many things we had to pushed back are now possible like going to the

- dentist,

- optician,

- doctor,

- gym,

- hairdresser,

- restaurant,

- cinema,

- etc.

Interestingly, our regular grocery shopping bill was also higher in May, compared to February, March and April.

My wife and I have a very down to earth lifestyle with a very clear focus on maintaining a robust savings rate. But we also want to enjoy our Path Towards Financial Independence and are quite relaxed with regard to our pent up demand for services and products after a period of subbdued spendings due to the previous lock-down months (March and April).

A 50 % savings rate is still very robust, also given the fact that our average monthly savings rate in 2020 is still around 65 %. We extract a lot of cash from our monthly inflows, trying to live off from 35 % of our incomes while using the excess 65 % to increase our cash pile and making our stock portfolio stronger.

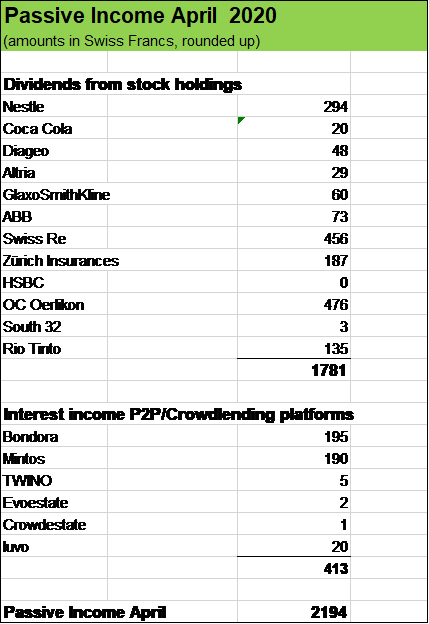

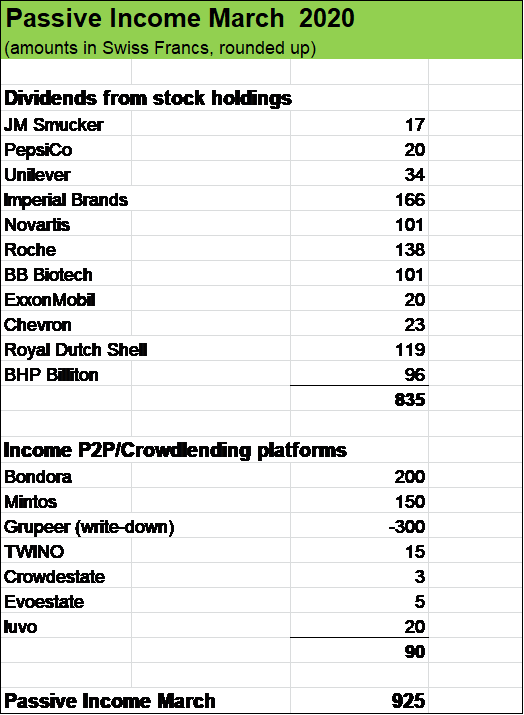

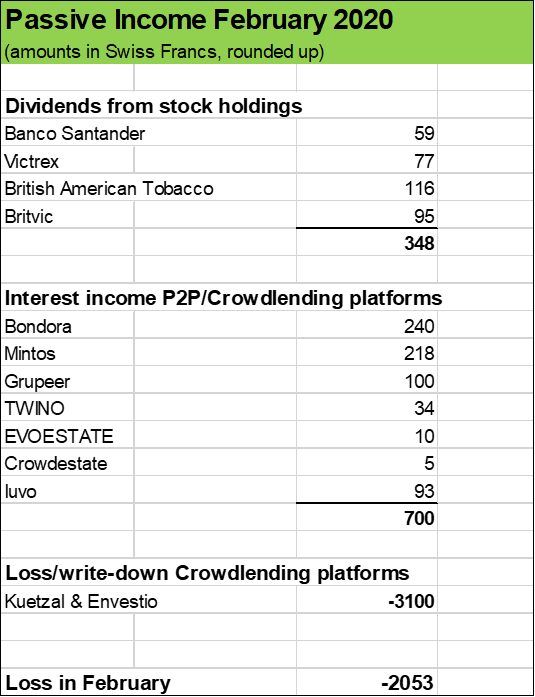

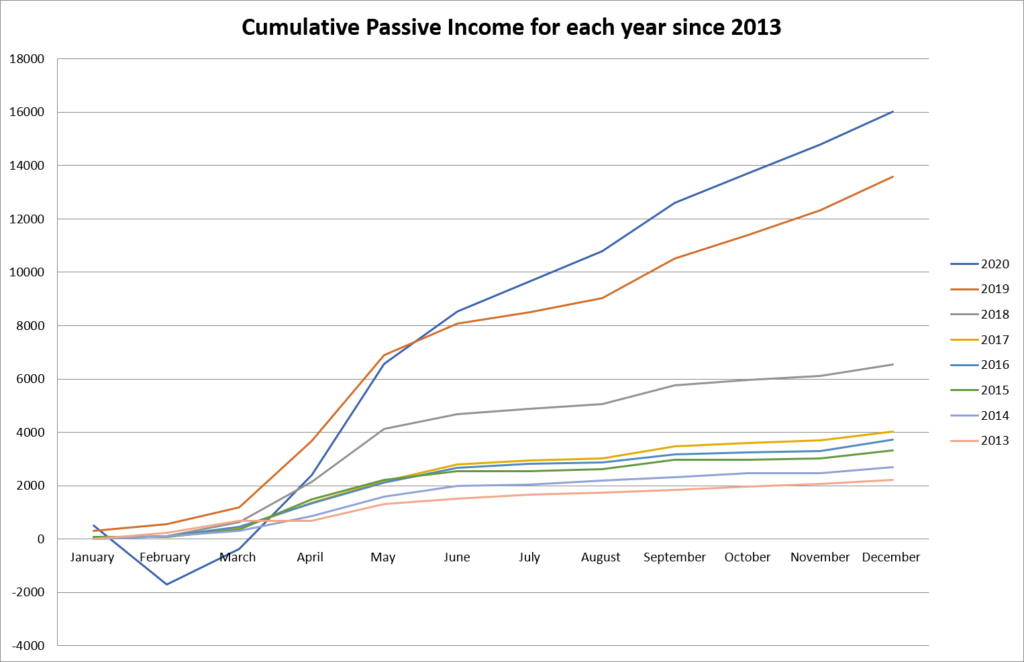

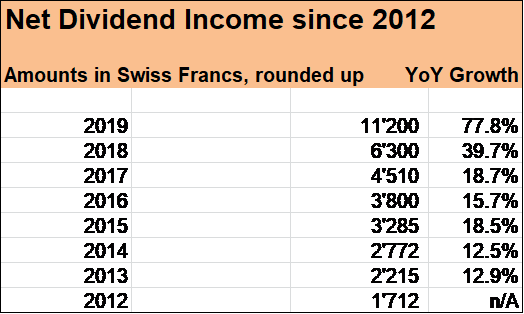

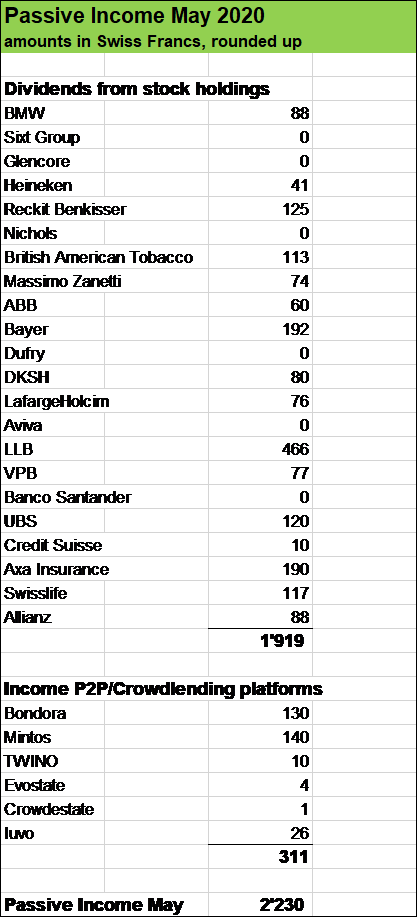

May Passive Income USD 2’230, down 45 % Year over Year

The COVID-19 pandemic and the lock-downs all over the world has a strong negative impact on the dividend income generation capability of our stock portfolio.

In May 2019, our dividend stocks generated over USD 3’200, compared to now USD 1’900. In fact, without incomes from our P2P/CL portfolio in the amount of over USD 300, the YoY would have been even more severe than that 45 % drop.

Income from our P2P/CL investments was lower compared to the previous month (ca. USD 300 vs. over USD 400 in April) which was due to our withdrawals from the platforms. Currently, we have around USD 38’000 invested on Mintos, Bondora, Iuvo, Evoestate, TWINO and Crowdestate.

Several of our May dividend income generators cut their payouts (e.g. BMW) or even suspended them entirely for the year (such as SIXT, Glencore, Dufry, Banco Santander).

There are also several businesses having postponed their shareholder meetings while some companies pledged to make additional payouts by the end of the year. Going through the COVID-19 pandemic while preserving cash is the right thing to do, so I am certainly not souring about these management decisions.

But of course, comparing May 2020 with the same month in the previous year is a tricky thing. The hard, cold numbers show a lower passive income in May, but there will certainly be some additional cash flows in the following months which will hopefully smooth out the YoY passive income drop in May.

We still maintain our 2020 full year Passive Income Goal of USD 20’000 which is an extremely interesting challenge. Clearly this is a “moving target” given the amount of uncertainties.

My guess would be that there is a strong potential for a recovery in the back half of the year, but of course always under the condition that there won’t be additional severe global disruptions (e.g. second COVID-19 wave, geopolitical tensions etc.). What I’ve learned in almost 20 years in investing is that despite all gloom and doom there is always plenty of room for positive developments and surprises.

Our Stock acquisitions in May

Market disruptions always provide opportunities. Prices change, things get more attractive and some businesses are now in a much much stronger position than before the COVID-19 pandemic.

My wife and I are always on the lookout of nice opportunites and in May we put the amount of roughly USD 8’500 to work by investing into following stocks:

- Amazon (USD 2’200)

- Alibaba (USD 1’800)

- Shopify (USD 2’800)

- Campari Group (USD 1’800)

Let’s start with Amazon, shall we? Well, Amazon is a real giant. The company sets its focus on e-commerce, cloud computing, digital streaming and artificial intelligence. Its strong business profile is supported by its ubiquitous brand name, its global reach and of course there is the increasing strength and profitability of Amazon Web Services (“AWS”), which accounts for the majority of the company’s operating income. Amazon Web Services offers scalable cloud computing services. Amazon is an ever growing giant, supported by its significant cash flow generation and excellent liquidity profile. This excellent liquidity is centered around nearly $20 billion of free cash flow, cash and equivalents of around $27 billion, and marketable securities of around $22 billion. From online shopping to AWS to Prime Video and Fire TV, the current COVID-19 Crisis with lock-downs all over the world has been demonstrating the adaptability and durability of Amazon’s business model as never before. And I am quite optimistic, that Amazon will continue to prosper.

Another Huge Tech Name we added to our stock portfolio in May is Alibaba Group Holding Limited, a Chinese e-commerce company, providing online and mobile commerce businesses in China and other international markets. Alibaba operates in four segments: e-commerce, cloud computing, digital media and innovation initiatives. While the company expects meaningful growth from all four segments over the medium and long term, its core commerce business is currently by far the most important one, generating almost all the earnings of the company.

Let’s come to the third and fourth stock addition in May:

Shopify Inc. is a Canadian multinational e-commerce company offering online retailers a suite of services “including payments, marketing, shipping and customer engagement tools to simplify the process of running an online store for small merchants.

In April, we acquired Alphabet (parent company of Google) and we now have a Mini-Tech-Portfolio with the additions of Amazon, Alibaba and Shopify. Through our holdings in class B Shares of Berkshire Hattaway (added last month), we indirectly also have a stake in Apple.

My wife and I are passionate Dividend Growth Investors, we like our core investments in businesses such as Nestlé, Roche, Novartis, Danone, Unilever, Coca Cola, PepsiCo etc. But we also have to face the fact that BIG TECH has become increasingly important, disrupting markets and competitors. In our view it is sensible to put a portion of our expected annual passive income (roughly USD 20’000) into TECH NAMES whenever we feel that their stock prices come down a little bit.

Then comes our last stock acquisition. Gruppo Campari is an Italian company, active since 1860 in the branded beverage industry. Camapari produces spirits, wines and soft drinks. The company has a very interesting brands portfolio, including Campari, Aperol, Appleton, Grand Marnier, SKYY Vodka, Wild Turkey etc. We had an eye on that company for years, it always showed a premium stock price with a price earnings ratio well above 30. Well, after having come down to 25 (on the basis of 2019 earnings), Gruppo Campari represents a very interesting and attracitv addition to our investment portfolio.

Preparing our trip to France for Real Estate Investments

By the end of 2019, my wife and I had made our plan to push things further and speed our Journey towards Financial Independence by building a real estate portfolio which will be our THIRD PASSIVE INCOME MACHINE, generating significant rental income in around two years.

My wife and I had initially planned to be in France the first week in April. But due to the COVID-19 pandemic we temporarily had to freeze that plan.

We now plan (again) our trip to France, this time in August. As we had to postpone our projects for some months, there was plenty of time for us going more into the details to prepare the real estate transactions and of course to build our cash pile further.

We have our eyes on three apartments (one, two and four rooms) in the city Mulhouse in France. It’s quite near to the Swiss border and what we plan is to buy real estates to rent them out lateron. The amount we plan to invest in 2020 is roughly USD 150’000. The whole plan has some complexity but is also amazingly exciting.

Equally important, we have our eyes on a very nice country house with a beautiful big garden. It’s a bit early, but we want to have a look at country houses it as we are considering to build our second mainstay in France, once we achieved Financial Independence.

What about you, fellow reader, did resp. do you take advantage of recent market volatility and acquired some stocks? How was your May in terms of Passive Income?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action