Hi there. Thanks for stopping by. I hope you had a splendid start into the New Year and wish you all the best for 2017!

I want to share with you some achievements we made in 2016 in regard of our savings rate. Read more… »

Hi there. Thanks for stopping by. I hope you had a splendid start into the New Year and wish you all the best for 2017!

I want to share with you some achievements we made in 2016 in regard of our savings rate. Read more… »

Can an investment in a solid and attractive – but “maturing” – company deliver decent returns despite slowing dividend growth?

Yes. But it is extremely important not to overpay and to take a long term view.

There are several wonderful businesses in my investment portfolio where I expect future growth to be weaker than in the last decades. I think in particular of Coca Cola, Nestlé, Novartis and Roche.

The Swiss company Roche has a market capitalisation of well above USD 200 Bn and is one of the largest pharma and biotechnology businesses in the world. It’s just massive!

In 2011, I acquired 18 non-voting shares of Roche at a price of around Swiss Francs 135 (CHF; trades more or less at parity to the USD).

Few weeks before I made that investment, shares of Roche had become kind of “unpopular” due to some damped expectations regarding profit contributions of one of its blockbuster drug. The stock price came down by around 20 %, making an investment even more attractive to me.

The worries of the market proved exaggerated, Roche delivered solid results and stock price quickly recovered. In the last four years, the trading range was between CHF 230 and 280.

I don’t focus too much on the stock price or book gains/losses regarding my investments, but it is still interesting to see how some short term market expectations can lead to quite a nice entry price.

Much more important for me is the cash flow I get in form of dividends.

When I make an investment, I want to see at least these two things over time:

If a stock investment does not meet (or excel) these two criteria, it does not contribute to my wealth building process.

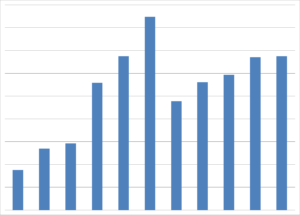

The dividend payments in that time period were as follows (in CHF; gross amounts before witholding tax): 3.00, 2.50, 4.60, 5.00, 6.00. The payouts doubled in just five years which is very strong.

If someone had bought Roche in 2005 and is still holding that investment, he or she would have been rewarded handsomely in the past and will be so spectacularily in the future.

From 2005 to 2015, Roche showed a dividend growth rate of well above 14 %. But there are two crucial points to consider:

From 2011 to 2015 the dividend payments (in CHF; gross amounts) from Roche were as follows: 6.80, 7.35, 7.80, 8.00, 8.10. The 5 year dividend growth rate was around 5.9 %, much less than in the past.

My investment in Roche falls exactly in that slow growth period.

Fair enough. Let’s have a look at the development of the yearly cash returns compared to my initial investment of CHF 135 in 2011 (yield at cost). The deduction of the Swiss witholding of 35 % has hereby to be considered (if there is a double taxation treaty with the country of the investor, twenty percentage points can be reimbursed to that investor to lower the tax rate to 15 %).

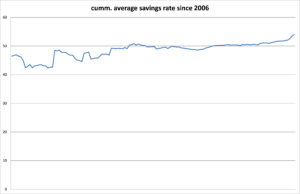

My dividend yields at cost (after witholding taxes) from 2011 to 2015 were as follows: 3.25 %, 3.54 %, 3.75 %, 3.85 %, 3.9 %.

I expect my dividend yield at cost for 2016 (paid in 2017) to be well above 4 %. In the last five years, I collected over 18 % of the invested amount in dividends.

These are quite decent returns so far (I don’t even factor in the book gain or dividend (re-) investments).

Just to put the dividend returns into relation: The dividend yield of my total portfolio currently stands at around 3.3 %, “organic growth” due to dividend hikes of my holdings has been between 3 % and 4 % in the past years. So Roche was an important contibutor to “organic growth” of my portfolio and I expect it to be so in future.

Roche is a leader in biotechnology, cancer treatment and diagnostics. The company shows a 28 years of consecutive dividend growth. The business has a broad economic moat and shows strong fundamentals and attractive growth prospects.

The increasing payout ratio of Roche shows that EPS growth didn’t catch up with dividend growth. For decades, the payout ratio was low (under 20 %) and “jumped” above 40 % in 2003. Since the financial crisis starting in 2007 the payout ratio climbed steadily to settle currently at around 55 %. Still quite comfortable. Dividends are very well covered by free cash flow and there is some room for growth. But I expect dividend growth hikes to be modest in the future.

As a long term investor I don’t complain about that. A slowing payout is even prudent by the company.

I will rather have a look whether

Stocks of an outstanding company such as Roche acquired at a fair price can still deliver very decent returns over time. And if dividends are reinvested, the compound effect can do miracles.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.

Just eleven days, and 2016 will be over. Time goes by so fast! It has been just an amazing year, I had a great time with my family and so much fun on our journey towards Financial Independence.

I want to share with you a brief look back to my passive income from dividends and interests which I have been tracking since 2012. I will also make some projections regarding future passive income streams.

As you can see, my two passive income sources developed quite differently. Read more… »

Hi there. Appreciate you stopping by!

Let me ask you a question.

Would you invest in a business that makes USD 100’000 in revenues and grows that amount by 10 % annually?

“Yes, if the price is right” you might answer. Investing in a growing business can make a lot of sense, after all such a revenue growth rate is to some extent an indicator that the business offers good products or services to its customers.

Fair enough.

And what would you say if the annual overheads of that company were USD 90’000 and grew by 12 % every year alongside with the revenues?

Hmm. Not so attractive anomymore, am I right?

The reason is quite clear and intuitive: although that company is able to consistently increase revenues by a remarkable annual rate of 10 %, profits are squeezed year by year as costs grow even faster. Such a business is not attractive as an investment. It is pretty clear, that the fundamentals of that company are leading to losses, eroding shareholder value over time. The prospect would be daunting. After just a few years, dividend payments would be cancelled or slashed or – even worse – be financed with additional debts which is to the detriment of the financial flexibility and risk position of the business. The compelling revenue growth of 10 % in our example came at very high costs and sooner or later such a company would be out of business.

As an investor, you are primarily interested in “your” company to make sustainable and growing profits. That’s the way shareholder value is created and increased over time. Successful companies (such as Johnson & Johnson, Coca Cola, Nestlé, Walt Disney) have a certain “financial behaviour”. For decades, they

Profits are the essence of successful businesses and consistently being reinvested make these companies real compounding machines. The difference between revenues and costs should be as wide as possible and – ideally – grow over time.

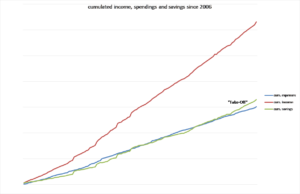

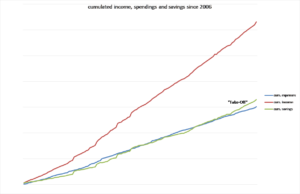

The equivalent of profits in terms of households are their savings, defined as the difference between income (take-home-pay etc.) less spendings.

Interestingly, people have a different measure of success, when it comes to households and their personal finances. While companies are considered to make profits, individuals are generally considered to

So, the focus of households is quite different from companies and is set on the renumeration for working hours and consumption. Or just simply put:

“One earns to spend”

Both – businesses and individuals alike – are considered to manage resources efficiently and handle economic risks. But more often than not, households act irrationally when it comes to their finances. High consumption is perceived as a “successful lifestyle”.

Just let’s take a highly paid executive for example, making USD 500’000 annually and getting a pay rise of 10 % every year. The general perception is: “he or she made it” – Right?

Most people wouldn’t even change their perception, if they knew that our highly paid executive took a mortgage of USD 1 Mio. to finance the house and yearly spendings accounted for USD 400’000 annually and are set to grow by 12 % each year. Savings are eroding year by year finally turning negative in the medium term. What’s the result? Accumulated wealth will decrease and finally additional debts have to be taken on to sustain the lifestyle level. High consumption is litterally eating away the savings of the highly paid executive putting him or her in a financially risky position.

Remember, if a company showed these financial fundamentals, no one would consider an investment in such a business as it would be considered as unattractive. Just think of it: the mortgage by far exceeds ten times the yearly savings of the highly paid executive. A company with debts higher than three times yearly profit is already considered as highly leveraged and risky. Rating agencies such as Moody’s, S&P and Fitch wouldn’t even consider a company with such fundamentals investment grade.

Although the highly paid executive in our example arguably and objectively is in an uncomfortable financial position, few people would see it that way.

Why is that?

In my humble opinion, it is deeply rooted in our society and part of our education system and worklife. We are consistently trained to be good, loyal and ambitious employees and in exchange we are put in a position to consume. “The more the better”.

What’s the problem with consumerism and depending on a job?

Someone who works hard just to spend most of his or her income is caught in a ratrace and is in a very risky position. There is usually just one source of income. People depend on a specific job and more often than not on an increasing income level to keep pace with their “standard of living”. It is very hard – and sometimes impossible – to change high fixed lifestyle costs in the short run. Taking a position with a lower income level e.g. to work on something he or her is passionate about would be perceived to be to the detriment of the “standard of living”.

Consumerism is not per se a bad thing, but it can make you stuck. You don’t have many options. How can you lead a voluntary life if you exist from paycheck to paycheck? It’s impossible to truly pursue your dreams and rise to the top of your capabilities.

You should save. As much as possible and as much as you feel good about and even increase your savings rate over time. After all, that’s what successful companies do. They increase profits, they grow, they thrive financially.

So should you.

Aim for a higher savings rate to streamline your finances and to gain financial flexibility.

Invest in productive assets, diversify your income streams and put your money to work for you instead of the other way around.

Make money your friend.

Slowly, but steadily increasing.

October was an extremely successful month in terms of our finances. We increased our savings rate well above 65 %, the best result ever (see page savings rate)! Our average rate for the current year now stands at 55.2 %.

But most important, my family and I have a great time. Being more conscious regarding our resources and our spending habits intensified our focus on meaningful things in life and gradually transforms it even to the better. Over and over again we are making the experience that a down to earth lifestyle makes much happier than costly habits. Read more… »