While the Jaws Ratio is commonly used in corporate finance and security analysis, you rarely hear or read about that measure in the context of personal finance. This is to some surprise, as households – like businesses – have to manage their economic resources and taking into account various financial risks and (life) events. Almost everyone has money issues – companies and people alike – so why not use that concept to increase your personal savings rate to put you in a position to make more of the money you earn?

First, I want to show you what that Financial Ratio stands for, how it is calculated and then – and this is most important – how you can benefit from knowing that concept.

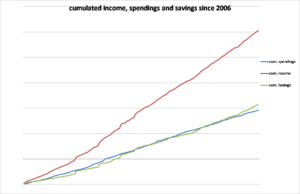

draw and shape your (financial) life

draw and shape your (financial) life