Our path towards Financial Independence by 31.12.2024

Hey there, fellow reader. Welcome to our MONTHLY PASSIVE INCOME UPDATE.

As my wife and I are working towards our goal to achieve FINANCIAL INDEPENDENCE by 31.12.2024, we set a strong focus on increasing our savings rate and boosting our passive income by acquiring “productive” assets.

Currently, we have TWO PASSIVE INCOME MACHINES:

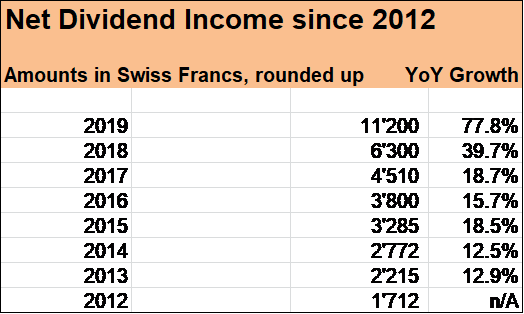

- A Stock Portfolio consisting of over 60 holding positions. In 2020, our portfolio is expected to generate more than USD 12’000 in dividends (net after taxes).

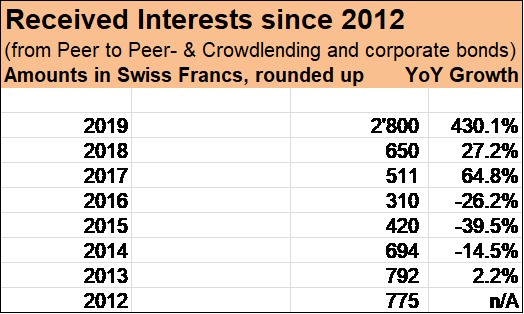

- A Peer to Peer (P2P) and Crowdlending Portfolio with roughly USD 60’000 invested on eight platforms, currently expected to generate roughly USD 600 in interest income per month.

Our short-term goal for these two PASSIVE INCOME MACHINES is to generate over USD 20’000 in 2020.

And we want to push things further by building a real estate portfolio which will be our THIRD PASSIVE INCOME MACHINE, generating significant rental income in around two years.

We have been living in Central Europe (Switzerland and Liechtenstein) for many years and are also considering to build a second mainstay in France for the time when we will have reached Financial Independence. That’s why we not only have our eyes on small appartments (buy to let) but also on residential properties.

So much about our visions and medium term plans. Now let’s get to the level of execution, where we set the basis to make things happen.

February Financial Numbers

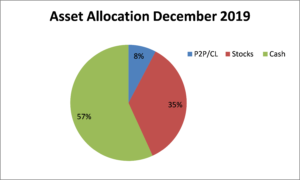

We had a very successful month. Our savings rate stands at around 65 %, fueling our investment process while our cash pile remained quite stable slightly above USD 500’000 (see our asset allocation as of 31.12.2019 here).

Since automn 2019, we have not added any stock holding to our portfolio (except dividend reinvestments) as prices have been quite high. So, our cash position could build up nicely for a couple of months.

We started building our P2P/CL portfolio in summer 2019 and basically just invested the funds which had been “freed” from corporate bonds as roughly USD 60’000 had been running off at that time.

Having a cash pile of over USD 500’000 gives us tremendous stability and flexibility in life and sets us in a position to benefit from (market-) opportunities whenever they arise. A large portion of the USD 500’000 will be used to acquire rental properties over the next two years. Our real estate portfolio will then be our Third Passive Income Machine, diversifying our cash inflows further.

My wife and I took advantage of increased market volatily during the last week in February and acquired stocks of four businesses, strengthening our First Passive Income Machine further. And we added a new P2P platform to our Second Passive Income Machine. I will get into these additions lateron.

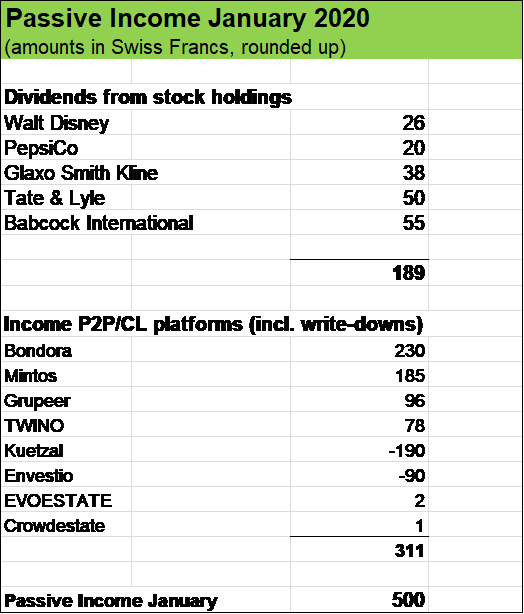

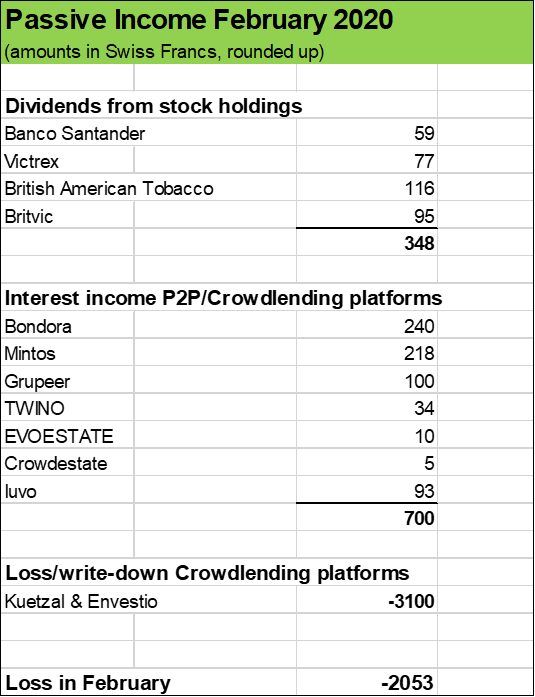

As you can see from the chart above, despite good cash generation from our stocks (USD 350) and our P2P/CL investments (USD 700), February showed quite a substantial loss on our Monthly Passive Income Statement in the amount of USD 2’000. This was due to the complete write-down of our two crowdlending positions Kuetzal and Envestio which both collapsed in January. I had initially planned to make the write-offs throughout the full year 2020 by evenly deduct roughly USD 300 each month. However, I took the decision to make the adjustment in one big move as I want all numbers (total wealth etc.) to be accurate.

Furthermore I find it extremeley important

- to face losses,

- analyse them,

- take my lessons to make a full re-assessment and necessary adjustments and

- then quickly move on to resume growth.

Now, let’s have a look at our current two Passive Income Machines.

USD 350 from our Stock Portfolio, a 33 % increase Year over Year (YoY)

Last year, we had three businesses paying us dividends in February in the amount of USD 264: Spanish Banco Santander, British American Tobacco and British soft drink maker Britvic. Now, we have one additional February dividend contributor: Victrex (position added in June 2019), which paid us USD 77.

Compared to February 2019, despite quite significant currency headwinds, around 10 % in additional dividend income was due to “organic growth” and reinvestments. Britivic and British American Tobacco both offer Dividend Reinvestment Programs (DRIP) and in the case of Banco Santander, one of the quarterly dividend distributions is paid in form of stocks.

Organic dividend growth of our February contributors was as follows:

- British American Tobacco: + 4 %

- Britvic: + 6.4 %

- Banco Santander: + 3 %

Victrex recently announced to keep its shareholder distribution unchanged. Victrex is the leading manufacturer of high-performance polymer which is known as PEEK. It’s a company with a broad economic moat and strong financials.

Further strengthening our stock portfolio by adding more businesses

As said, February showed very nice volatility in the markets and some stocks got hammered. Well, that’s when we get interested in acquiring pieces of quality businesses at lower prices.

My wife and I really like consumer staple companies such as Nestlé, Unilever, Heineken, Coca Cola, PepsiCo, Britvic, Nichols, Berentzen etc.. These are companies that build the backbone of our portfolio, pieces of businesses rewarding long term shareholders for their patience.

Late in February, we invested the amounts of roughly USD 2’000 (each) in Fevertree and Danone. We also pulled the trigger just a few days later to acquire stocks of British Petroleum (BP) and US tobacco giant Altria (MO), in the amount of USD 2’000 for each position as well.

So, February was a good Investment month in which we put a total of USD 8’000 to work.

Now, let’s have a look at these stock acquisitions.

Fevertree, the British producer of premium drink mixers (tonic water, lemonade, ginger beer etc.) has been on our watchlist for quite some time. The business was founded in 2004 and has shown remarkable growth. In just a matter of few years, Fevertree products surpassed sales of Schweppes (Coca Cola) to become the market leader. Fevertree’s financials are strong and I see many drivers for further growth. Our yield on cost is low, somewhat above 1 % but the company’s business model is asset light, Fevertree is highly cash generative and I wouldn’t be surprised to see very nice cash returns over the medium term. I’d be surprised to see the stock price sinking over the next two years, which will give me the opportunity to pile in more stocks of a company I like very much. Currently, our position is quite small, as we only put USD 2’000 into Fevertree, and to take advantage of further stock price pressure.

Danone S.A. is a French multinational food-products corporation based in Paris. The business has three segments:

- specialized nutritian (Aptamil)

- waters (Evian, Volvic etc.)

- dairy and plant-based products (Activia, Actimel etc.

Danone is significantly smaller and less diversified than Nestlé and Unilever but is still larger and much more international than many of its peers e.g. like J.M. Smucker. Growth has been robust over the past decades but Danone has certainly never been a “high-flyer”, which is good, stock price levels have been more or less reasonable.

Danone is a well managed consumer goods company that has a very strong focus on brand building. It’s interesting, for instance, that Danone has invested much more in marketing as a percentage of sales than many of its peers. Return on equity has consistently been in a range of 12 to 15 % in the past years and Danone has been in the process of deleveraging. The balance still looks a bit stretched, very obviously acquisitions of the past years have left their marks, I see the same with J.M. Smucker for instance, which in my view overpaid for their latest pet food acquisitions. Danone’s forward price earning comes clearly below 20. Not cheap, but I would say that we paid a fair price for a very solid business.

US tobacco giant Altria has been on my watchlist for some time. I like the strong cash generation and relatively moderate debt level of the company. Altria made an investment into e-cigarate maker Juul last year and I was quite sceptical about the price they paid (over USD 12 Bn). In my view, Altria overpaid, in particular given the problems Juul faces. I wasn’t at all surprised to see Altria write down almost 2/3 of the invested amount. I guess many investors are very disappointed how Altria handled that acquisition and it is certainly one reason for the very depressed stock price. Another reason is the declining volumes of cigarettes consumed in the US. Altria only operates in that market, in contrast to its sister company Philips Morris which produces and sells its products globally. On the other hand, Altria is the clear market leader in the US with its flagship brand Marlboro accounting for more than 40 % of the whole cigaret market. Altria’s pricing power could compensate falling stick volumes but of course this cannot going on for years. Geographically, Altria seems very focused and also vulnerable. But don’t let’s forget that the company has a significant stake in the word largest beer producer AB Inbev and investments in wine businesses. Offering a dividend yield of 8.5 %, it was just too tempting for me, that’s why I pulled the trigger during the big sell-off late in February.

Another holding, we added late in February was oil major British Petroleum currently having a dividend yield of over 8 %. I can remember, when I took a stake in Royal Dutch Shell in 2009, when there was still a market mood as the world was falling appart and of course it was only hindsight visible that the financial crisis and the market sell-off had found its bottom at that time. Today, of course things are different. But with a 8 % dividend yield due to a stock price that had been falling quite significantly, not only do I see a margin of safety but also good chances to make British Petroleum a solid long term investment. Of course it will be bumpy,road depending very much on oil price fluctuations and clearly the dividend could be cut (we have seen this in the past) but British Petroleum has also been amazingly resilient for decades.

Over USD 700 income from P2P/CL platforms, more than offset by BIG write-downs

Our two P2P flagships Mintos and Bondora performed very well in February and so did Grupeer, TWINO and our much smaller positions Evoestate and Crowdestate.

The February performance of these six platforms is quite interesting given the fact that as a reaction to the collapse of Kuetzal and Envestio and amid a major risk-re-assessment from my side, I had reduced our P2P/CL portfolio by almost 10 %, making several withdrawals (EUR 3’000 from Bondora, EUR 600 from TWINO, EUR 450 from Evoestate, EUR 200 from Mintos). I also completely wound down our position in Fastinvest (EUR 500).

The main reason for the strong performance is fact, that interest rates have been higher on Mintos and Grupeer compared to the previous months. For instance, by the end of February, net annual return on Mintos stood at 12.3 %, compared to slighlty above 10 % by the end of 2019. Grupeer now also has a lot of loans returning 14 %.

We are in the process of reducing our positions in Grupeer and TWINO by 50 % over the next months and have already started to build up a new positon in Iuvo Group, where we invested the amount of EUR 2’500 and already received a bonus (as we registered through an affiliate link) in the amount of EUR 90.

Iuvo is an Estonian P2P platform which started in 2016.

Here’s what we like:

- Iuvo Group is profitable

- loan originators on the platform are profitable

- all loans on the platform come with a buyback guarantee from the loan originators

- loan originators must keep 20 – 30 % “skin in the game” (e.g. on Mintos: usually 5 – 10 %)

- Iuvo is very transparent with regard to loan originators etc. (in contrast e.g. to Fastinvest)

Unfortunately, the buyback guarantee does not cover interest rates. So, for instance when a loan is late resp. in default, it will be bought back by the loan originator within 60 day, but in the meantime, the invested amount of course does not earn any money. And there is another aspect, which is the flipside of a less risky P2P platform: the returns are lower. I expect them to be in a range of 5 % – 8 % (Grupeer e.g. offers loans with 13 – 14 % but is the more risky platform in my view).

Some thoughts on P2P risks

The collapse of Kuetzal and Envestio taught me several very valuable lessons. Of course, it’s almost certain that these platforms have been scams and it hurts in particular, to lose money that way.

But some important lessons certainly are:

- never ever invest in a platform that offers a buyback guarantee granted by itself combined with the promise to investors to buy back loans whenever investors want to sell. This combination is a serious red flag. It’s a recipe for huge platform risks.

- Never ever invest in a platform which does not disclose its financial reports (not being profitable is not a knock out criteria, but at least the platform has to be transparent about that fact).

Kuetzal and Envestio showed not only the above noted red flags but even worse things.

The days after these platform collapsed, I started to seriously doubt on the robustness of our whole P2P/CL portfolio.

That’s good! It was the start of a self reflection process and I made a major risk re-assessment.

One major result: I concluded for myself, that I want to continue building our P2P/CL portfolio but only with established platforms such as Mintos and Bondora, and of course to become much more cautious. TWINO, Evoestate, Grupeer don’t show red flags. We will be cautious but that’s an important conclusion for myself.

For instance, TWINO issues itself loans and puts some of them on the platform, granting a buyback guarantee. The company is profitable and has several hundreds of employees. The company has a proven track record. TWINO also has a secondary market. Investors can sell their loans to other investors, but it’s not TWINO that has to buy these loans.

Kuetzal and Envestio “promised” both, buyback in case of default of loans and additionally to buy back loans in case investors wanting to exit their investments.

Fastinvest was a platform in our portfolio where we saw several red flags and had no place in our portfolio anymore. For instance, it buys back loans from investors that want to exit their investments and in case of the default of a loans, loan originators buy them back after just 5 days. This would require significant cash resources from Fastinvest and absolutely high quality loan originators with strong profitability and perfect liquidity management. Fastinvest however neither discloses its own financial reports nor the names of its loan originators. A significant lack of transparency with a huge platform risk is a combination we are not tolerating anymore after the Kuetzal and Envestio debacles.

Grupeer is not yet profitable. Grupeer discloses its loan originators which is more than what Fastinvest does. What I don’t like about Grupeer though is that there still is no secondary market and that Grupeer has a close relationship to at least one large loan originator (the founders of Grupeer have a stake in the loan originator) which could have the potential for a risk concentration. On Grupeer, loan defaults are not visible and are “handling internally”. I prefer Bondora, Mintos, TWINO and Iuvo in this respect, being much more transparent.

When it comes to P2P lending, 25 % to 30 % loan defaults are not uncommon. Today, when I hear “zero default rate”, I am super careful. Because that’s unusual. I would say that everything below 20 % is rather unusual.

“Zero defaults” in crowlending is like a stock investor saying that his resp. her portfolio never fluctuatiates by more than 3 % per month and that it has been steadily climbing for years while dividend inflows steadily increasing by 10 % annually. Really? How is that possible? We all know, that investor rewards come from taking volatility and by taking calculated risks. And we all know, that over the lifetime of an investor, he or she will see the portfolio cut in half several times and everyone knows that dividend cuts can happen from time to time. Heck, even Warren Buffet saw KraftHeinz and AB Inbev dividends being slashed.

Anyway. In the end, there is always someone absorbing the risks. And as long as I am compensated for risks I know, I am fine. Transparency is super important.

I had stopped all automatic reinvestments on Grupeer months ago and decided to sharply reduce our stake on that platform.

TWINO is profitable but had some financial problems in the past. So, here we want to be careful and reduce our position further.

Mintos and Bondora of course come with their specific risks as well. For the time being though, we decided to keep the positions unchanged (note: I already reduced our Bondora invesments by EUR 3’000 by the end of January) and let our current positions compound. The same with Evoestate and Crowdestate, here no changes for the time being.

Moving towards our USD 20’000 passive income milestone

Each year in February or March, I make my “Passive Income Projections“. I put the expected inflows from our income generating assets and assume no other investments during the year. It’s something I have been doing since 2013 and it’s amazing, how accurately these projections are. At the beginning of the year of course I don’t know all dividen hikes from our over 60 stock holdings yet, but it’s still accurate, as there can be currency headwinds or dividen cuts or other adversities.

The “Passive Income Projections” are the basis, from where we are moving upwards towards achieving our milestones by putting our savings to work.

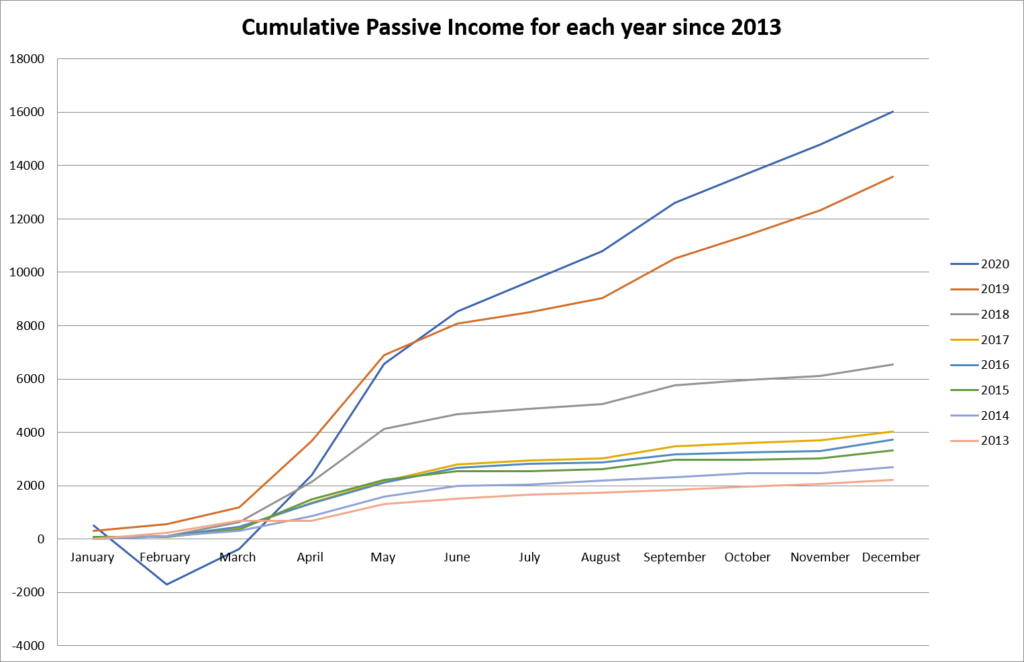

Let’s have a look at the graph. For 2020 (blue line), the picture is particularily interesting, as in February we had a loss for the first time (write-down Kuetzal and Envestio). You can see the blue line (cummulated passive income) falling to almost minus (!) USD 2’000 but then recovering quite nicely over the next months and then in May surpassing the 2019 passive income of the same month.

Currently, I am projecting USD 16’000 in dividends and interest income from our P2P/CL investments.

In 2019 we had 14’000 total passive income, so how is it possible to be higher than in the previous year even if we didn’t invest any new funds in 2020?

This is due to two factors:

- First, several stock acquisitions we made in 2019 will pay their annual dividends for the first time in 2020 (Berentzen, Massimo Zanetti etc.) or in the case of semestrial or quarterly distributions, the whole dividend amounts will be paid in 2020 in contrast to 2019 (3M, Victrex. etc.). And of course, the stock acquisitions we made late in February 2020 contribute nicely to our forward passive income for the year.

- Secondly, our P2P/CL portfolio was established in August 2019. Now it will be running over 12 months with “full amount invested” (roughly USD 60’000 in loans will generate USD 7’200). Even taking into account the write-downs for Kuetzal and Envestio, there will be a significantly higher total interest income amount than in the previous year.

Our trip to France to visit real estate properties

My wife and I will be in France the first week in April. First, we will visit three apartments (one, two and four rooms) in the city Mulhouse. It’s quite near to the Swiss border and what we plan is to buy real estates to rent them out lateron. The amount we plan to invest in 2020 is roughly USD 150’000. The whole plan has some complexity but is also amazingly exciting.

We also have our eyes on a very nice country house with a wonderful garden. It’s a bit early, but we want to have a look at it as we are considering to build our second mainstay in France, once we achieved Financial Independence.

What about you, fellow reader, how was your February in terms of Passive Income?

Did resp. do you take advantage of recent market volatility and acquired some stocks?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.