Taking a stake in Britvic, topping up on existing positions in Reckit Benkiser and Imperial Brands

Since the market top in January, many stocks of very interesting businesses came down quite nicely. In March, I decided to use the price weakness to put around USD 11’000 of my cash pile to work and acquire some shares of following British consumer staple companies:

- Britvic (370 shares)

- Reckit Benkiser (50 additional shares)

- Imperial Brands (70 additional Shares)

The recent market drop provides me with the opportunity to give my investment portfolio a more defensive shape. Let’s have a look at these three businesses.

Britvic – British Vitamins for my portfolio

The history of the British soft drink maker goes back to the mid-nineteenth century, when the British Vitamin Products Company was founded. The business produced fruit juices and marketed them under the Name Britvic.

Today, Britvic is a strong soft drinks company with operations in Great Britain, Ireland, France and Brazil.

Britvic has a compelling portfolio of its own brands such as Robinsons, Tango, J2O, Teisseire, Fruité, Maguary and DaFruta. In addition the company produces and sells a number of PepsiCo’s soft drinks brands, including Pepsi, 7UP and Mountain Dew, under an exclusive agreements with PepsiCo.

My dividend Yield on Costs on the acquired stock positions stands at 3.9 %, adding USD 140 to my projected annual dividend income. The company went public around ten years ago and has shown a quite nice dividend growth story over the last decade. Britvic’s payout ratio stands at around 50 % and combined with very healthy growth prospects for the company, chances are good that cash inflows from dividends will rise quite substantially over time, strengthening my portfolio even further.

Reckit Benkiser – “boring” and highly profitable

The British consumer goods giant ReckitBenkiser is a business I wrote about last summer in a blogpost when I first purchased shares of the company.

Reckit Benkiser operates in two segments with an immensly strong brand portfolio:

- Health (Enfamil, Scholl, Nurofen, Mucinex, Strepsils, Lysol, Clearasil, Veet, Durex etc.)

- Home Hygiene (Harpic, Finish, Air Wick, Cillit Bang, Calgon, Vanish etc.)

Reckitt Benkiser compares favourably to better known consumer defensive businesses such as Church & Dwight, Procter & Gamble or Unilever. The company has a very robust free cash flow generation. The underlying business is extremely profitable with returns on capital regularly in the range of 25%. There are not many consumer stocks showing similar business economics.

So, there is a lot to like about Reckit Benkiser. But in recent years, organic growth was anemic. In 2017, the company has spent more than £14 billion to acquire Mead Johnson Nutrition, a global player in infant nutrition. For a company the size of Reckit Benkiser, that’s quite a large acquisition, net debt stands at five time the company’s Free Cash Flow. Reckit Benkiser has a pretty defensive business model but management should have an eye on the deleveraging process to regain its financial flexibility and stability. A clear focus on organic growth and the Integration of Mead Johnson in order to realise synergies and streamlined operations should help to make the company even stronger over the medium term.

My YoC on the recently acquired Reckit Benkiser stocks stands at around 3 %, adding over USD 120 to my current projected annual dividend income.

Imperial Brands – a clearly out of favour stock

The British tobacco company Imperial Brands is the world’s fourth largest cigarette producer with brands like Davidoff, Gauloise, West, Winston, Kool. The company is also the world’s largest producer of cigars (Montecristo, Cohiba, Golden Virginia), fine-cut tobacco (Drum), and tobacco paper (Rizla, the world’s best-selling rolling paper). Furthermore, Imperial Brands has a 50 % stake in Habanos with its legendary cigar brands and the company has the majority of the shares of Logista, a logistic business which services tobacco and non-tobacco customers.

As we all know, tobacco companies are facing huge pressure (regulations, falling sales etc.) on their top line growth. And compared to its larger peers (British American Tobacco, Philipps Morris Int. and Japan Tobacco), Imperial Brands has been falling back when it comes to innovations to strengthen its Next Generations Products (e-vapour products, heated tobacco products). Its larger competitors also have a much more international footprint.

On the other hand, Imperial Brands still has strong growth catalysts, a compelling cash generation and strong financial fundamentals (the deleveraging process is under way). Based on my purchase price , my projected YoC is at around 7.5 %, adding approximatively USD 270 to my projected annual dividend income.

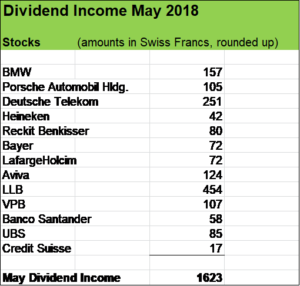

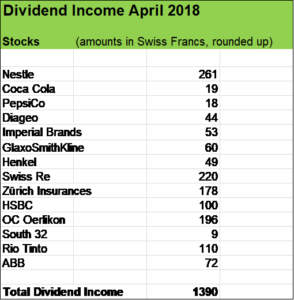

Current projected dividend income in 2018 now exceeds USD 6’000

After the three stock acquisitions (Britvic, ReckitBenkisser and Imperial Brands) and due to further organic dividend growth on my existing positions, my current projected dividend income for the year now is well above USD 6’000, one third higher than in the previous year (2017: USD 4’500).

Almost all of the businesses in my share portfolio have already made their dividend announcements, whereas

- 30 companies hike(d) their dividends

- 4 businesses declared steady dividend payouts and

- 2 corporations are set to slash their payouts

Let’s have a look at the list with the companies in my portfolio increasing their payouts, their dividend hikes and my projected YoC (net after taxes):

- BMW + 14.3 %; YoC 4.1 %

- Porsche Automobil Hldg. + 74 %; YoC 3.3 %

- OC Oerlikon + 16 %; YoC 5.1 %

- VP Bank + 22 %; YoC 6.8 %

- LLB + 17 %; YoC 5.5 %

- Bayer + 3.7 %, YoC 1.6 %

- AVIVA + 18 %; YoC 4.8 %

- Legal & General + 7 %, 5.4 %

- Diageo + 5 % %, 3.6 %

- PepsiCo + 15 %; YoC 2.4 %

- Coca Cola + 5.4 %; YoC 2.64 %

- Nestlé + 2.7 %; YoC 5.11 %

- Heineken + 9.7 %; YoC 2.2 %

- Walt Disney + 7.7 %; YoC 1.55 %

- Imperial Brands + 10 %; YoC 6 %

- Reckit Benkiser + 7 %; YoC 2.75 %

- Henkel + 10.6 %; YoC 1.4 %

- Chevron + 3.7 %; YoC 3.3 %

- Zurich Insurance + 5.8 %; YoC 8 %

- Swiss Re + 3.2%; 5.2 %

- UBS + 8 %; YoC 4.2 %

- Deutsche Telekom + 8.3 %; YoC 5 %

- Orange + 7.7 %; YoC 2.6 %

- Roche + 1.2 %; YoC 5 %

- Novartis + 1.8 %; YoC 4.33 %

- ABB + 2.6 %; YoC 3.33 %

- Nokia + 11.7 %; YoC 1.5 %

- BHP Billiton + 39 %; YoC 5.3 %

- Rio Tinto + 60 %; YoC 6.5 %

- South32 + 100 % (increase ordinary dividend plus special dividend)

My “dividend growers” clearly function as a plattform for further growth, providing me with additional cash to fuel my investment process.

What about you fellow Reader, have you added some new positions to your portfolio? What do you think about my recent stock acquisitions?

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.