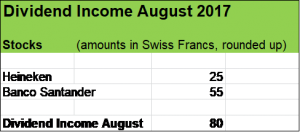

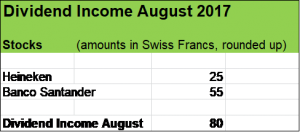

August has been an amazingly interesting month. Read more… »

August has been an amazingly interesting month. Read more… »

Hi, fellow reader, appreciate you stopping by.

In this post I want to give you an overview on our investments we have made so far during the year.

My family and I had a great time this summer, travelling and looking for interesting projects. And of course we have been shaping our finances even further. In July we were able to boost our monthly savings rate above 70 %, for the year our rate now stands at 65 % (my fellow blogger Mustachian Post runs a very inspiring Blogger Savings Rate Index (BSRI), check it out!). Read more… »

This post was contributed by Amy Nickson, a passionate writer on finance. Amy is a professional blogger whom has started her own blog and also works as a contributor for the Oak View Law Group. Please share your opinions by commenting below.

‘Probability’, ‘Risk’, ‘Ifs’, ‘Buts’, ‘Uncertainty’, these are very troubling factors in our life. When will it be a good time, or when it will run rough, we can never estimate, no matter how hard we try.

Finance and monetary issues are needed to be understood in detail to cope up with unexpected expenses in life. I always love to say, there is nothing called unexpected expense or anything as such. I believe we are not capable enough in proper money management and thus fall prey to tough financial emergencies. Read more… »

Hey there! Thanks for stopping by!

It’s time for an update on my monthly dividend income.

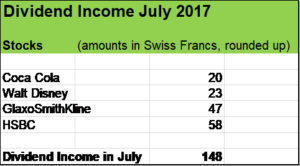

In July, Coca Cola, Walt Disney, GlaxoSmithKline and HSBC provided my with passive income of around USD 150, tripling my dividend inflows for that month year over year. Read more… »

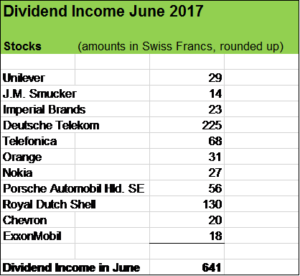

Over the first six months of 2017, my stock holdings have paid me the cummulative amount of USD 3’000 in dividends and I’m quite well on track for my full-year goal of USD 4’500.

In June, following eleven businesses from four different sectors paid me dividends in the the amount of USD 640 :