In 2020, amid the COVID-19 pandemic, I took the decision to build up a Tech Portfolio to have more exposure to the secular trend towards increasing digitalization of our economies and societies as a whole.

I have been a dividend growth investor since 2009 and continue building that passive income machine which is set to churn out USD 15’000 in 2021 and has so far generated over USD 50’000 in cummulative dividend income in the last decade.

Amid a raging bullet market, both of our two independent stock portfolios increased to a market value of well above USD 450’000 which is a very nice development.

On the other hand, higher stock prices makes it costly to add to share portfolios.

But in my view there are still some company stocks worth having a closer look at. One of them is Japanese multimedia and gaming giant Nintendo.

Through Microsoft (XBox, Minecraft) and Draftkings I have already some exposure to the gaming sector. But Nintendo in contrast is a pure gaming play with an incredible brand portfolio and franchises. You find numerous names we all know, such as:

- Mario

- Donkey Kong

- The Legend of Zelda

- Animal Crossing

- Pokémon

- etc.

Nintendo also holds a major stake in The Pokémon Company.

Nintendo has a broad array of entertainment products including

- portable and console game machines,

- home console hardware (Nintendo Wii, Nintendo 3DS etc.),

- software for home console and portfable gaming machines,

- trump card and Karuta (Japanese-style playing cards),

- consumer electronics

- etc.

Nintendo has an incredible IP (intellectual property) which it can potentially leverage significantly. Take for instance the theme park Super Nintendo World.

Nintendo was founded in 1989 and for decades, its consoles and games have been popular with hundreds of millions around the globe. Nintendo has staying power and benefits of strong brand loyalty.

The Nintendo stock currently offers a dividend yield of around 4 % which is quite interesting given the robust financials and resilient business model on the back of iconic brands and franchises.

Nintendo distributes roughly one third of its free cash flow to its shareholders while at the same time consistently reinvesting into its business and ventures.

Nintendo offers some nice opportunities, but I would like to see a stronger move into streaming and a more bold approach in leveraging its IP. Nintendo could also move to subscriptions models to establish recurring revenue streams.

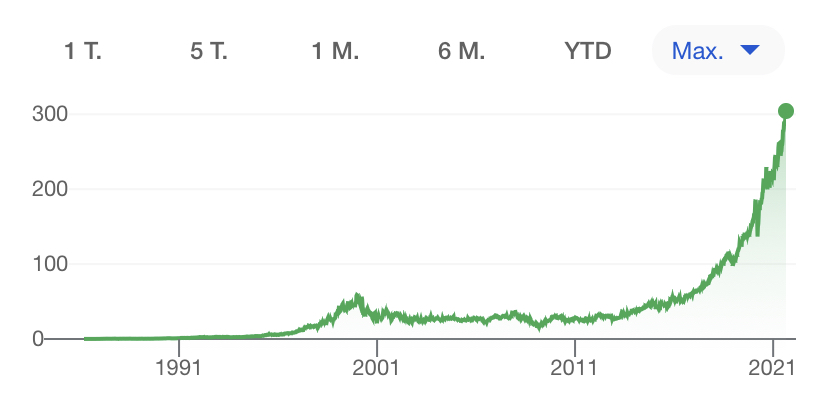

Compared to The Walt Disney Company which is in a deep transformation process, focusing on streaming (Disney + etc.), Nintendo has a different approach, which to some extent is reflected in the stock price dynamic. Nintendo is innovative in terms of new devices, but from time to time, they flop like the Wii U in 2012. Nintendo combines hardware and software but as said, streaming and leveraging its strong IP could boost the company’s profitability. Being not more aggressive, could lead to missed opportunities.

Nintendo offers a decent stock price with a well covered dividend yield of 4 % combined with attractive growth prospects.

I initiated a position for around USD 3’000, adding to my forward dividend income over USD 100 per year.

What about you, fellow reader, did you buy some stocks recently? What’s your opinion on the Nintendo stock?

Thanks for sharing your thoughty in the commentary section below.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.