Trying out new things to learn more about investing

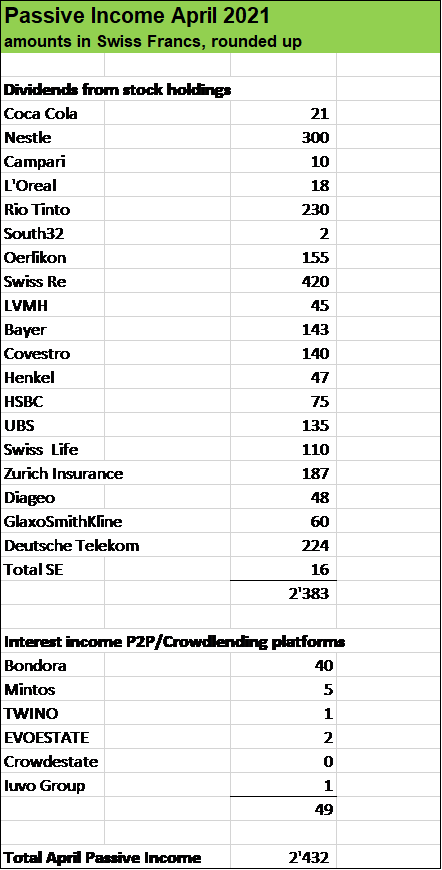

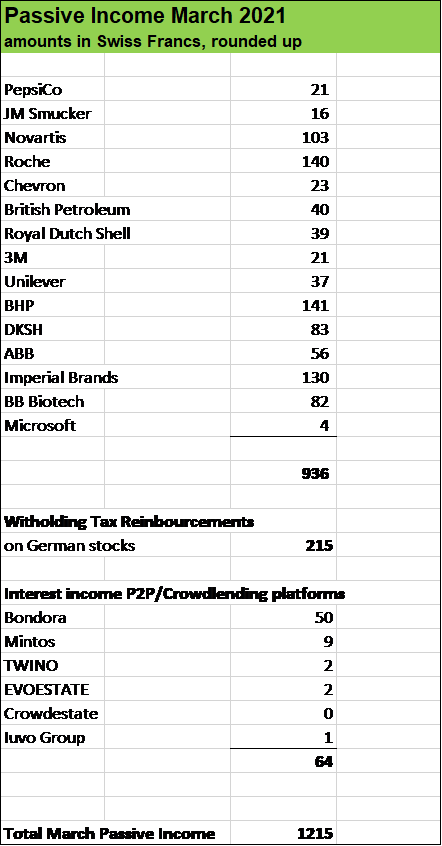

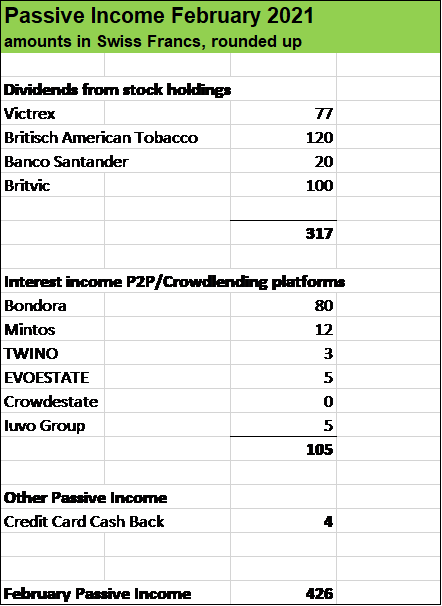

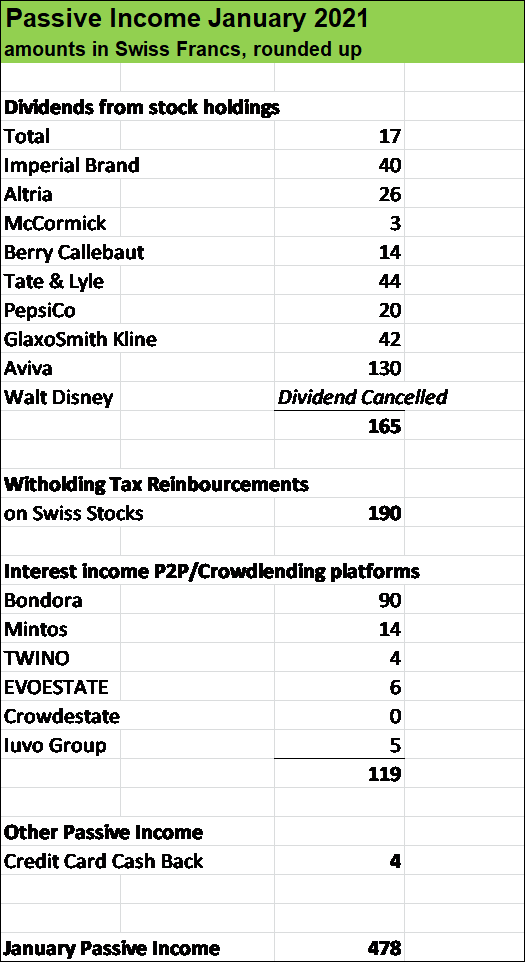

My wife and I have been passionate Dividend Growth Investors for years. We love high quality businesses that have been able to raise their dividend payouts for years. It’s amazing to use the power of the Compound Effect and see more and more Passive Income flowing in year by year.

In summer of 2019, I decided to start a Peer to Peer and Crowdlending Portfolio to diversify our Passive Income streams further.

Then in 2020, in the midst of the COVID-19 pandemic, I initiatied a Tech Portfolio as I saw a huge shift towards digitalization.

As of today, our Dividend Stock Portfolio and Tech Portfolio have a combined market value of well over USD 420’000 with very nice book gains in particular on our Growth Stock Holdings such as Alphabet, Facebook or Amazon.

Passive Income is set to achieve at least USD 15’000 in 2021.

Initially, my wife and I had planned to buy rental properties in France, amongst others to diversify our Passive Income Streams further. But due to the travel restrictions amid the COVID-19 pandemic our possibilities to find good rental properties to acquire were very limited and we therefore decided to posponed that plan. In 2022 we will be able to pursue that plan again. We need to travel without any restrictions, to visit real estate properties, meet with people etc.

But as always, trying out new things, helps us well to gain experiences which serve us well on our Journey towards Financial Independence.

Taking a small stake in Bitcoin, Ethereum and Ripple

In February 2021, I initiated positions in Bitcoin (XBT) and Ethereum (ETH) for a total of somewhat below USD 1’000 and started another position in Ripple (XRP) a few days ago for an amount of somewhat below USD 1’000.

So far (as of Monday, 3.5.2021), the book gains are quite nice:

- ETH: + 103 % gain resp. USD 438

- XBT: + 24 % gain resp. USD 103

- XRP: – 4 % loss resp. – USD 38

There is a huge speculative element when it comes to taking a stake in Crypto Currencies which brings significant risks. On the other hand, Bitcoin, Ehtereum and Ripple are connected with important applications which have huge potential to completely transform our economy and the way we interact.

The first time I really had a deeper look at that topic was when I built our Tech Portfolio, in particular when I took a stake in fintech businesses Square and Paypal which are both set to disrupt the entire banking industry.

So, here we go: I bought cryptos for around USD 2’000 and will hold these positions for the long run. I’ll share how things work out with that “investing adventure”.

What about you, fellow reader, do you have some Cryptos? It would be great if you shared your experiences or opinions below.

Disclaimer

You are responsible for your own investment and financial decisions. This article is not, and should not be regarded as investment advice or as a recommendation regarding any particular security or course of action.